Procedure for Tax consequences worksheet entry

Procedure for Tax consequences worksheet entry

Outline

Outline

In [Tax consequences worksheet entry], you can register closing balance for temporary discrepancy items. Worksheet entry is always required before [Execute deferred tax accounting] is performed.

1. Screen display method

1. Screen display method

- Select [Additional accounting] → [Deferred tax accounting] → [Entry].

- Select [Tax Consequences Worksheet Entry] from the menu.

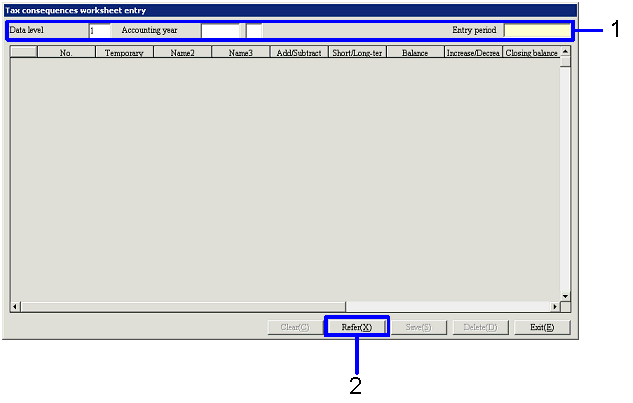

→ [Tax consequences worksheet entry] screen will appear.

2. Data level specification

2. Data level specification

→ To Menu Reference

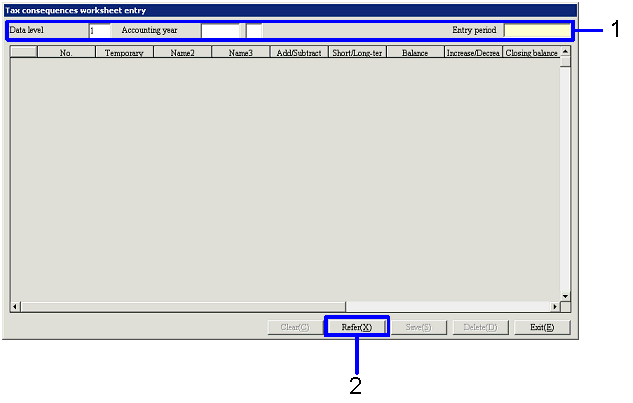

- Enter "Data level" and "Accounting year" to be registered.

The range of "Data level" is "1"-"20." If you enter "Accounting year," "Entry period"

will be displayed.

- Click "Refer (X)" button.

3. Register balance

3. Register balance

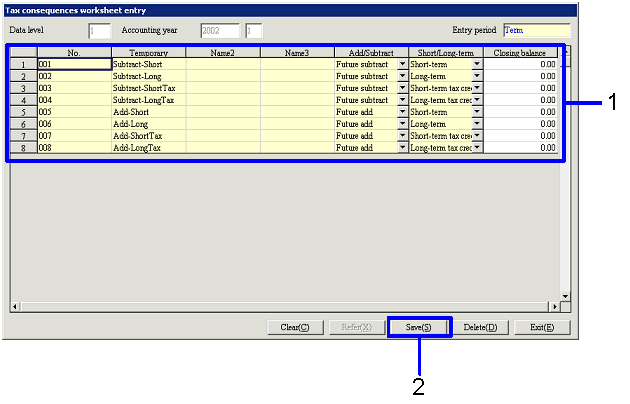

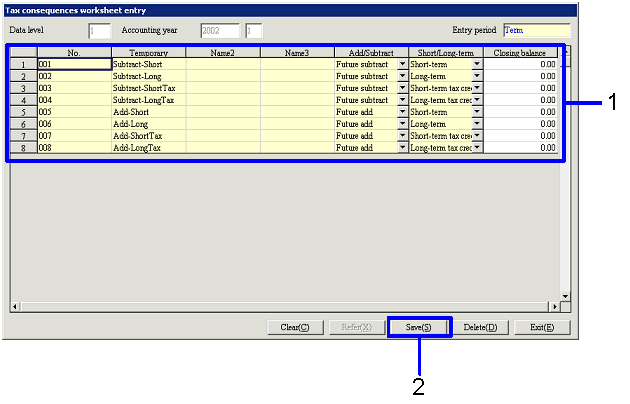

- Specify "Increase/Decrease amt" and "Closing balance" for each temporary discrepancy item on the spread (When one of the two is entered, the other will be displayed with auto-calculated value).

- Click "Save (S)" button.

4. Setup for the first use of tax consequences worksheets

4. Setup for the first use of tax consequences worksheets

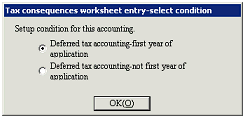

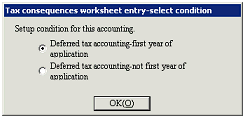

- Once the [Tax consequences worksheet entry-select condition] screen is activated, select the appricable options and click "OK (O)" button (this screen does not appear after the second entry).

![]() Procedure for Tax consequences worksheet entry

Procedure for Tax consequences worksheet entry![]() Outline

Outline![]() 1. Screen display method

1. Screen display method![]() 2. Data level specification

2. Data level specification

![]() 3. Register balance

3. Register balance

![]() 4. Setup for the first use of tax consequences worksheets

4. Setup for the first use of tax consequences worksheets