Procedure for Execute deferred tax accounting

Procedure for Execute deferred tax accounting

Outline

Outline

[Execute deferred tax accounting] automatically creates journal to apply the deferred tax accounting based on the contents in [Tax consequences worksheet data].

1. Screen display method

1. Screen display method

- Select [Additional Accounting] → [Deferred tax accounting] → [Entry].

- Select [Execute Deferred Tax Accounting] from the menu.

→ [Execute deferred tax accounting] screen will appear.

2. Specify searching conditions

2. Specify searching conditions

→ To Menu Reference

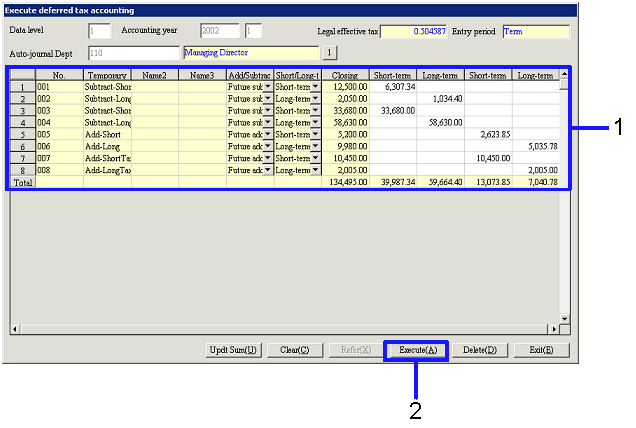

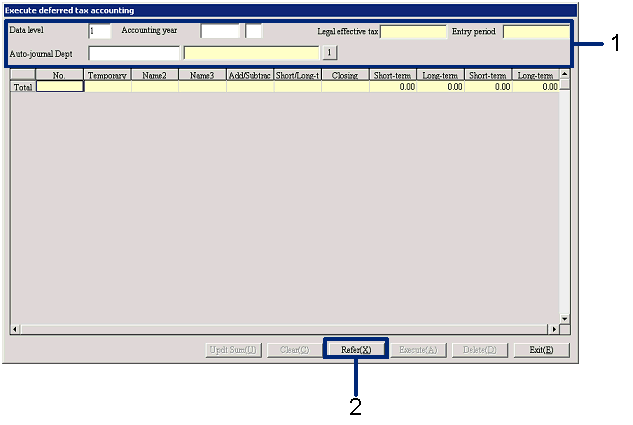

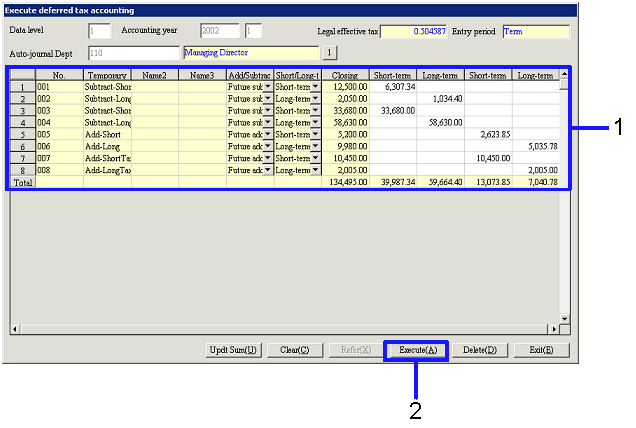

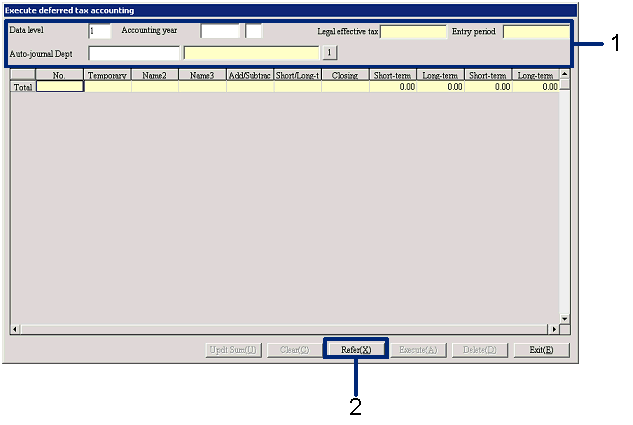

- Select the "Data level," "Accounting year" and "Auto-journal Dept" to be registered.

A department specified in "Auto-journal dept" will be registered as the department for the voucher. According to "Data level" and "Accounting year," "Legal effective tax rate" and "Entry period" that have been set up are displayed.

- Click the "Refer (X)" button.

3. Register balance

3. Register balance

- "Short-term deferred tax assets," "Long-term deferred tax assets," "Short-term deferred tax debts" and "Long-term deferred tax debts" are summarized on display by temporary discrepancy item in the spread. The data can also be modified.

- Click the "Execute (A)" button.

→ Auto-journal will be performed, displaying the [Transfer voucher] screen. After entering necessary items, click the "Commit" button and "Save" button to return to [Execute deferred tax accounting].

![]() Procedure for Execute deferred tax accounting

Procedure for Execute deferred tax accounting![]() Outline

Outline![]() 1. Screen display method

1. Screen display method![]() 2. Specify searching conditions

2. Specify searching conditions

![]() 3. Register balance

3. Register balance