Outline of the Deferred Tax Accounting Module

Outline of the Deferred Tax Accounting Module

Outline

of the Deferred tax accounting module

Outline

of the Deferred tax accounting module

In [Deferred tax accounting module], you can

register temporary discrepancy items as templates and enter closing balance in

a worksheet, making it possible to automatically create journal to apply the deferred

tax accounting. Since the template

registration and worksheet entry can be done by data level, the data can also

be auto-journalized by data level.

In addition, it features journal adjustment for the deferred tax

accounting-first

year of application.

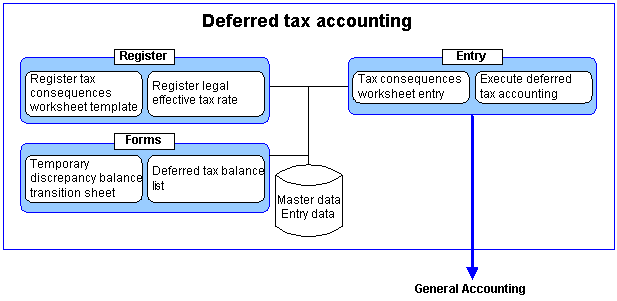

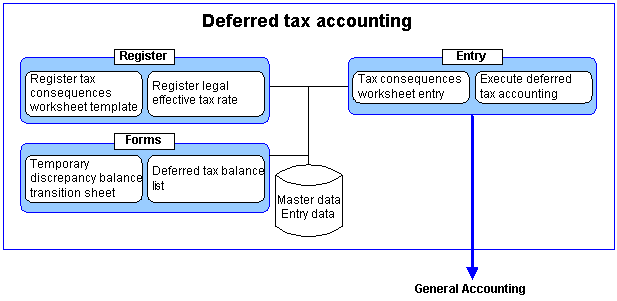

Menu structure

Menu structure

Forms that can be output

Forms that can be output

In [Deferred tax accounting module], the

following forms can be output:

Click here, for more information on output forms.

Notes

Notes

- Pre-register

Prior to using the deferred

tax accounting module, you need to set up "Deferred tax accounting A/C"

and "Tax rate formula" in [Parameter setup] of [System custodian module].

- Restriction of data entry,

modification and deletion

Because the data entry in the deferred tax worksheet

should be made in an order of accounting year and period, the system controls not

to allow you to skip a subsequent period.

You cannot also enter, modify or delete the deferred tax worksheet data that

had been created before the accounting year and period when the deferred tax

accounting was executed, as well as the deferred tax accounting data for the

year when annual update was executed.

- Exclusive control

The system controls simultaneous access by multiple

operators. The restriction applies

to [Register tax consequences worksheet template], [Register legal effective

tax rate], [Tax consequences worksheet entry] and [Execute deferred tax

accounting], not allowing several operators to access to work on at the same

time. When one operator is in

access to one of the four menus, other operators cannot access any menu. When a menu is selected, the error

message "Cannot be started because it is being

executed by other operator" will appear.

- Warning on annual update and monthly update

The data entry should be done in [Tax consequences worksheet entry] and [Execute

deferred tax accounting] in an order of accounting year and period, but if

monthly update is executed, skipping [Execute deferred tax accounting], you won't

be able to execute the deferred tax accounting for the month or later. Similarly, if annual update is

executed, skipping [Tax consequences worksheet entry] and [Execute deferred tax

accounting], you won't be able to make the tax consequences worksheet entry and

deferred tax accounting execution for the next accounting year or later.

- Row deletion in [Register

tax consequences worksheet template]

When you delete rows of temporary discrepancy items

in [Register tax consequences worksheet template], the data that was saved on

the temporary discrepancy items will also be deleted together. As a result, the temporary discrepancy

items won't be displayed in [Tax consequences worksheet entry] and [Execute

deferred tax accounting].

- Balance entry in [Tax consequences worksheet entry]

"Deferred tax accounting-first year of application"

is selected in the first entry of [Tax consequences worksheet entry], the data

will be auto-journalized for the applicable first year in [Execute deferred tax

accounting]. Meanwhile, when "Deferred

tax accounting-not first year of application" is selected, auto-journal won't

be performed in [Execute deferred tax accounting].

![]() Outline of the Deferred Tax Accounting Module

Outline of the Deferred Tax Accounting Module![]() Outline

of the Deferred tax accounting module

Outline

of the Deferred tax accounting module![]() Menu structure

Menu structure

![]() Forms that can be output

Forms that can be output![]() Notes

Notes