Procedure for Register legal effective tax rate

Procedure for Register legal effective tax rate

Outline

Outline

In this section, you can register the legal

effective tax rate and the entry period for the deferred tax accounting on the accounting

year.

1. Screen display method

1. Screen display method

- [Additional accounting] → [Deferred tax accounting] → Select [Register].

- Select [Register Legal Effective Tax Rate] from the menu.

→ [Register legal effective tax rate] screen will appear.

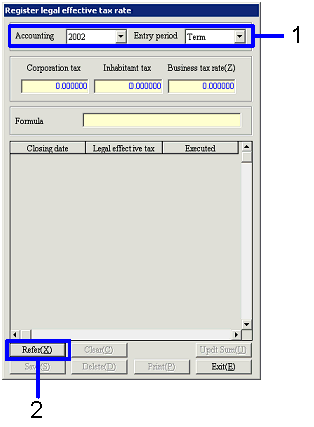

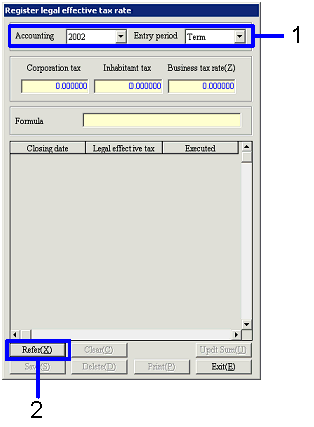

2. Entry period specification

2. Entry period specification

→ To Menu Reference

- Enter "Accounting year" and "Entry period."

"Corporation tax rate," "Inhabitant tax rate," "Business tax rate" and "Formula" are just for display, no modification is allowed. The data registered in [Parameter setup] of [System custodian module] will be displayed.

- Click "Refer (X)" button.

→ A list of the entry period will be displayed on the spread.

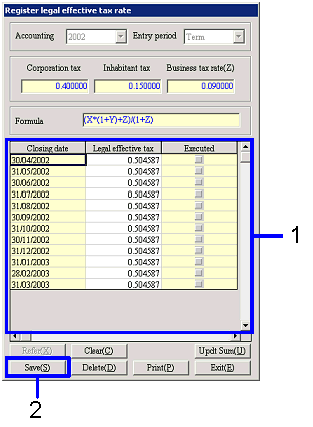

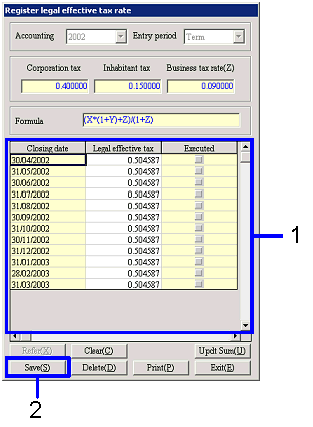

3. Legal effective tax rate specification

3. Legal effective tax rate specification

- All items are displayed on the spread in accordance with the

specified entry period.

In "Closing date," the last date of the each entry period is

displayed. A checkbox for the

period of which the deferred tax accounting has been executed will be ON. No modification is allowed. In "Legal effective tax rate,"

the default displays tax rate that is calculated with "Formula" but

modifacitions can be made.

- Click the "Save (S)" button.

![]() Procedure for Register legal effective tax rate

Procedure for Register legal effective tax rate

![]() Outline

Outline![]() 1. Screen display method

1. Screen display method![]() 2. Entry period specification

2. Entry period specification

![]() 3. Legal effective tax rate specification

3. Legal effective tax rate specification