Parameter

Setup

Parameter

Setup

Set the

parameters to lay the foundation of A.S.I.A. operation. These parameters include the setting of

whether auto-journals are needed, auto-journal A/C, initial display A/C, and so

on.

→ To About Parameter

Screen Transition

Screen Transition

[Server

applications]

↓

[System

Custodian]

↓

[Parameter

Setup]

↓

[Parameter

Setup]

↓

[Parameter Setup] screen - [Parameter

setup 1], [Parameter setup 2], and [A/C setup1 - 3]tabs

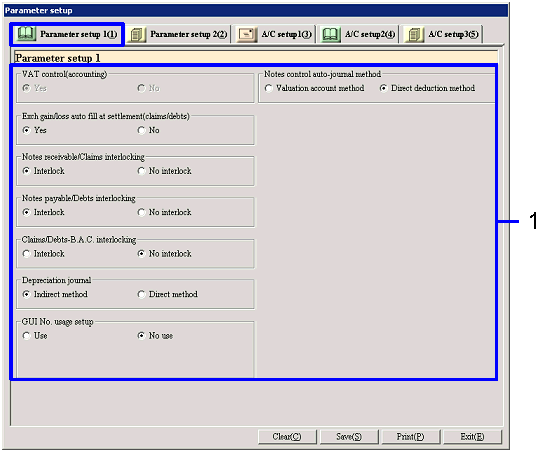

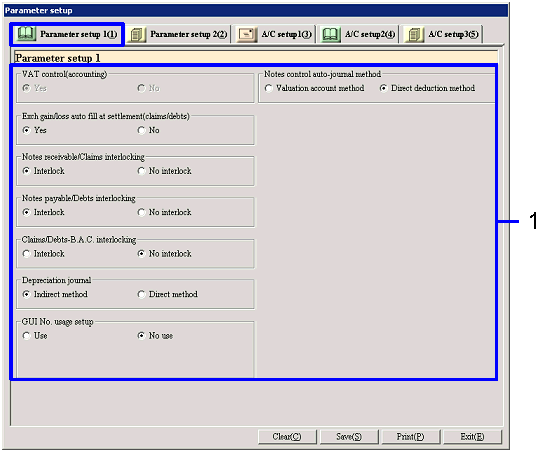

Item Setup - [Parameter setup

1] tab

Item Setup - [Parameter setup

1] tab

- Setting the parameter(1)

Set the parameters involving the system operation in general, such as VAT

control or depreciation journalizing system in the accounting subsystem.

- VAT control (accounting)

Determine whether tax control is needed in the accounting subsystem, auto-journal

object data, or the like. If any journal

data already exists, this area becomes light-colored and no change can be

added.

Choosing "Yes" enables you to add up the tax amount on each Taxable type/A/C in

[VAT summary sheet by taxable type]and[VAT detailed

sheet by taxable type].

Choose "No" if you use the VAT control function in Hong Kong or other

country/region where the VAT is not institutionalized.

- Exchange gain and loss auto fill at

settlement (claims/debts)

Determine whether the exchange gain and loss is included in Claims/Debts/Settle. If any settlement data exists, this

area becomes light-colored and no change can be added.

- Notes receivable/Claims

interlocking

Determine whether [Notes receivable Module] and [Claims Control Module] are interlocked with each other.

If any settlement data with its Settle type already included in "Notes

receivable" exists, this area becomes light-colored and no change can be added.

- Notes payable/Debts interlocking

Determine whether [Notes payable Module] and [Debts Control Module] are

interlocked with each other. If

any settlement data with its Settle type already included in "Drawing of NP"

exists, this area becomes light-colored and no change can be added.

- Claims/Debts-B.A.C. interlocking

Determine whether [Unpaid Control Module] and [Bank account control Module] interlock each other. Changes can be made freely.

If "Interlock" is selected, you must enter "Settle type" in [Debts entry] on

[Unpaid Control Module]. If you

select the "Auto-transfer" Settle method, you must enter items such as "JBA

code," "JBA account code," "Bank account type," and so

on.

- Depreciation journal

Select either "Indirect method" or "Direct method"

to determine the method of automatically journalizing the depreciation in [Fixed Assets Module].

Changes can be made freely.

- GUI No. usage setup

Determine whether GUI No. is used in the Sales

Control Subsystem. Changes can be

made freely.

If "Use" is selected, a message that reads "GUI No. Auto-numbering during Sales

Entry" appears on the display.

- GUI No. Auto-numbering during Sales

Entry

Determine whether the GUI No. is automatically

numbered in [Sales Control Module]. Changes can be made freely.

- Notes control auto-journal method

Select either "Valuation account method" or "Direct

deduction method" to determine the method of automatically journalizing the Discount/Endorsement

procedure in [Notes receivable Module].

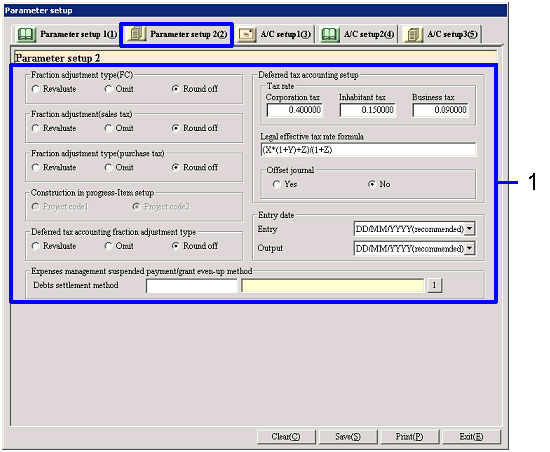

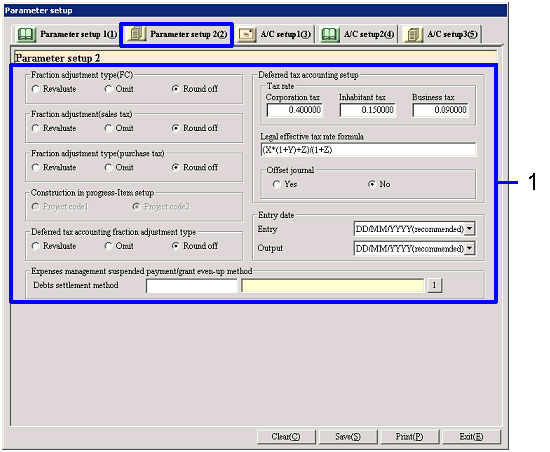

Item

Setup - [Parameter setup

2] tab

Item

Setup - [Parameter setup

2] tab

- Setting the parameter(2)

Set the parameters involving system operation in

general, such as fraction adjustment type, Input/Output date format, and so on.

- Fraction adjustment type (FC)

Amt (SC) is automatically calculated if any entry

is made with foreign currency. For

this calculation, you can choose the method of fraction adjustment from "Revaluate,"

"Omit," and "Round OFF." Changes

can be made freely.

- Fraction adjustment (sales tax)

Select "Revaluate," "Omit," or "Round OFF" to

determine the method of fraction adjustment of Sales Tax in Accounting Subsystem

and Sales Control Subsystem.

Changes can be made freely.

- Fraction adjustment type (purchase

tax)

Select "Revaluate," "Omit," or "Round OFF" to

determine the method of fraction adjustment of Purchase Tax in Accounting Subsystem

and Purchase Control Subsystem.

Changes can be made freely.

- Construction in progress-Item setup

Select the project code for use in "Construction

in progress code" in [Construction in progress Module].

If any "Construction in progress" account data already exists, this area

becomes light-colored and no change can be added.

- Deferred tax accounting fraction

adjustment type

Select "Revaluate," "Omit," or "Round OFF" to determine

the method of fraction adjustment when effective tariff is multiplied in [Deferred tax

accounting Module]. Changes can be made freely.

- Tax rate

Enter "Corporation tax rate," "Inhabitant

tax rate," and "Business tax rate" for use in [Deferred tax

accounting Module].

- Legal effective tax rate formula

Enter the formula to calculate the legal effective

tax rate in [Deferred tax accounting Module].

Corporate tax rate=X. Business

tax rate=Y. Inhabitant tax rate=Z. Use these formulae and combine

numerical values, brackets, and the four basic operations for arithmetic to

establish the legal effective tax rate formula.

|

Example: If the legal effective tax rate is (Corporate tax rate × (1+Inhabitant

tax rate)+

Business tax rate)/(1+Business

tax rate),

then the formula is(X*(1+Y)+Z)/(1+Z).

|

- Offset journal

Determine whether the offset journalizing of

deferred tax assets and liability is needed in the Auto-journal processing of [Deferred tax

accounting Module]. If any journal data on the deferred tax

accounting already exists, this area becomes light-colored and no change can be

added.

- Entry date

Select the date display format for use when data is entered in "Entry." Then select the date display format for

use when forms/output voucher is output in "Output." Changes can

be made freely.

- Methods of evening-up T-Expns/E-Expns

and Suspended payment/Grant settlement

Set the initial display of the debts settlement method for use in the Suspended

payment even-up/grant data out of the payment plan data prepared in [Create expense management data] in [Expenses management Module]. Selection is possible only in the debts

settlement method with "Settle type" set to "Other errors."

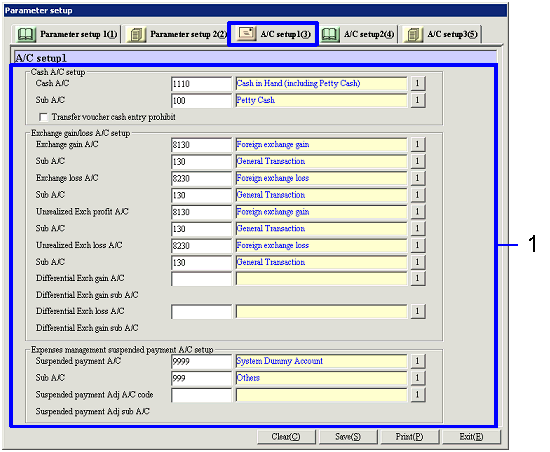

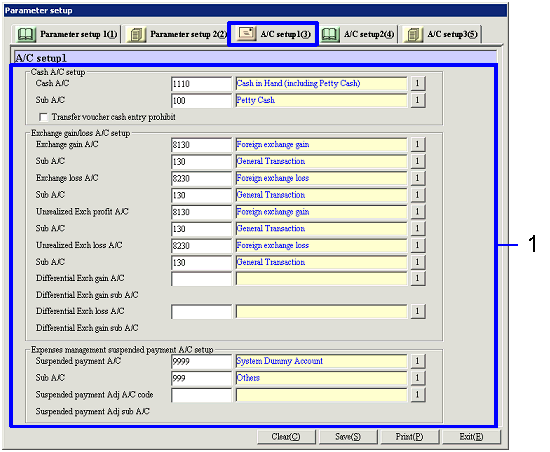

Item

Setup - [A/C setup1-3] tab

Item

Setup - [A/C setup1-3] tab

The above is an example of [A/C setup1] tab.

- Setting A/C 1

Set the A/C for use in Cash A/C, Profit

carry-forward A/C, Exchange gain and loss A/C, and Expenses

management suspended payment A/C.

- Cash A/C, Cash sub A/C

Set the Cash A/C // Sub A/C to appear on the initial display of Dr in [Receiving

voucher] and on the initial display of Cr in [Payment voucher]. The A/C/Sub A/C that can be set in this

procedure are only those with "SP type" set to either "Cash" or "Bank

deposit" in [Register A/C and Sub A/C].

- Transfer voucher cash entry

prohibit

If this check box is ON, you cannot enter any Cash A/C in the transfer voucher. Click this box ON to enter Cash A/C in

the Receiving voucher/Payment voucher.

- Exchange gain A/C, Exchange gain

sub A/C

Set the A/C // Sub A/C to add up the realized exchange

gain that occurs when [Revaluation for FC] is

executed with the use of lower cost method. The only A/C that can be set in this procedure are those

with "SP type" set to "Exchange gain" in [Register A/C and Sub A/C].

Be sure to make this setting if you chose "Yes" in "Exch gain and

loss auto fill at settlement(claims/debts)" on [Parameter1] tab.

- Exchange loss A/C, Exchange loss

sub A/C

Set the A/C // Sub A/C to add up the realized

exchange loss that occurs when [Revaluation for FC]

is executed with the use of lower cost method. The only A/C that can be set in this procedure are those

with "SP type" set to "Exchange loss" in [Register A/C and Sub A/C].

Be sure to make this setting if you chose "Yes" in "Exch gain and

loss auto fill at settlement(claims/debts)" on [Parameter1] tab.

Unrealized Exch valuation profit A/C,

Unrealized Exch valuation profit sub A/C

Set the A/C // Sub A/C to add up the unrealized

exchange valuation profit that occurs when [Revaluation for FC] is

executed with the use of Reversing method. The only A/C that can be set in this procedure are those

with "SP type" set to "Exchange gain" in [Register A/C and Sub A/C].

Be sure to make this setting if you chose "Yes" in "Exch gain and

loss auto fill at settlement(claims/debts)" on [Parameter1] tab.

Unrealized Exch valuation loss A/C,

Unrealized Exch valuation loss sub A/C

Set the A/C // Sub A/C to add up the unrealized exchange valuation loss that

occurs when [Revaluation for FC] is

executed with the use of the Reversing method. The only A/C that can be set in this procedure are those

with "SP type" set to "Exchange loss" in [Register A/C and Sub A/C].

Be sure to make this setting if you chose "Yes" in "Exch gain and

loss auto fill at settlement (claims/debts)" on [Parameter1] tab.

Differential Exch gain A/C, Difference

Exchange gain sub A/C

Set the A/C // Sub A/C to add up the Exchange gain. The only A/C that can be set in this

procedure are those with "SP type" set to "Exchange gain" in [Register A/C and Sub A/C].

Be sure to make this setting if you chose "Yes" in "Exch gain and

loss auto fill at settlement (claims/debts)" on [Parameter1] tab.

Differential Exch loss A/C, Differential

Exch loss A/C Sub A/C

Set the A/C // Sub A/C to add up the Exchange loss. The only A/C that can be set in this

procedure are those with "SP type" set to "Exchange loss" in [Register A/C and Sub A/C].

Be sure to make this setting if you chose "Yes" in "Exch gain and

loss auto fill at settlement (claims/debts)" on [Parameter1] tab.

Suspended payment A/C, Suspended

payment sub A/C

Set the A/C to add up the suspended payment in [Expenses management Module] (optional setting). You can choose from any A/C. Be sure to enter the Sub A/C if you specified any A/C that

has Sub A/C.

Suspended payment Adj A/C code, Suspended

payment Adj A/C code Sub A/C

Set the A/C to add up the even-up adjustment of suspended payment in [Expenses management Module] (optional setting). You can choose from any A/C. Be sure to enter the Sub A/C if you specified any A/C that

has Sub A/C.

- Setting A/C 2

Click [A/C setup2] tab to make settings on the

initial display of VAT A/C and the A/C for use

in [Bank account control Module].

- Temp sales order VAT etc. A/C, Temp

sales order VAT sub A/C

Set the A/C to add up the temporary sales order VAT

and the like (optional setting).

The only A/C that can be set in this procedure are those with "SP

type" set to "Cr side VAT" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified any A/C that has Sub A/C.

- Suspended payment VAT etc. A/C, Suspended

payment VAT sub A/C

Set the A/C to add up the suspended payment VAT and

the like (optional setting). The

only A/C that can be set in this procedure are those with "SP type"

set to "Dr side VAT" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified any A/C that has Sub A/C.

- T/F commission A/C, T/F commission

A/C Sub A/C

Set the T/F commission A/C for use in [Bank account control Module] (optional setting). You can choose from any A/C. Be sure to enter the Sub A/C if you specified any A/C that

has Sub A/C.

- Receipt excess adjustment A/C,

Receipt excess adjustment sub A/C

Set the initial display of the Receipt excess adjustment A/C for use in [Bank account control Module] (optional setting). You can choose from any A/C. Be sure to enter the Sub A/C if you specified any A/C that

has Sub A/C.

- Receipt deficit adjustment A/C,

Receipt deficit adjustment sub A/C

Set the initial display of Receipt deficit adjustment A/C for use in [Bank account control Module] (optional setting). You can choose from any A/C. Be sure to enter the Sub A/C if you specified any A/C that

has Sub A/C.

- Setting A/C 3

Click [A/C setup3] tab to make settings on the A/C

for use in [Execute deferred tax accounting] in [Deferred tax accounting Module].

- Short-term deferred tax assets A/C,

Short-term deferred tax assets sub A/C

Set the A/C to add up the short-term deferred tax

assets (optional setting). The

only A/C that can be set in this procedure are those with "A/C type"

set to "Assets" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified

any A/C that has Sub A/C.

- Long-term deferred tax assets A/C,

Long-term deferred tax assets sub A/C

Set the A/C to add up the long-term deferred tax

assets (optional setting). The

only A/C that can be set in this procedure are those with "A/C type"

set to "Assets" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified

any A/C that has Sub A/C.

- Short-term deferred tax debts A/C,

Short-term deferred tax debts sub A/C

Set the A/C to add up the short-term deferred tax

debts (optional setting). The only

A/C that can be set in this procedure are those with "A/C type" set

to "Liability" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified

any A/C that has Sub A/C.

- Long-term deferred tax debts A/C,

Long-term deferred tax debts sub A/C

Set the A/C to add up the long-term deferred tax

debts (optional setting). The only

A/C that can be set in this procedure are those with "A/C type" set

to "Liability" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified

any A/C that has Sub A/C.

- Corporate tax etc. adjustment A/C, Corporate

tax etc. adjustment sub A/C

Set the A/C to add up the amount of corporate tax

etc. adjustment (optional setting).

The only A/C that can be set in this procedure are those with "A/C

type" set to "Profit adjustment (P/L)" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified any A/C that has Sub A/C.

- Prior year tax consequences Adj A/C,

Prior year tax consequences Adj sub A/C

Set the A/C to add up the amount of prior year tax consequences adjustment (optional

setting). The only A/C that can be

set in this procedure are those with "A/C type" set to "Profit

adjustment (P/L)" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified any A/C that has Sub A/C.

- Adjustment A/C for total notes

excess, Total notes excess adjustment sub A/C

Set the A/C to add up the amount of total notes excess adjustment (optional setting).

The only A/C that can be set in this procedure are those with "A/C

type" set to "Profit adjustment (P/L)" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified

any A/C that has Sub A/C.

- Adjustment A/C for total notes

deficit, Total notes deficit adjustment sub A/C

Set the A/C to add up the amount of total notes deficit adjustment (optional setting). The only A/C that can be set in this procedure are those with

"A/C type" set to "Profit adjustment (P/L)" in [Register A/C and Sub A/C].

Be sure to enter the Sub A/C if you specified

any A/C that has Sub A/C.

[Buttons]

[Buttons]

![]() Parameter

Setup

Parameter

Setup![]() Screen Transition

Screen Transition![]() Item Setup - [Parameter setup

1] tab

Item Setup - [Parameter setup

1] tab

![]() Item

Setup - [Parameter setup

2] tab

Item

Setup - [Parameter setup

2] tab

![]() Item

Setup - [A/C setup1-3] tab

Item

Setup - [A/C setup1-3] tab

![]() [Buttons]

[Buttons]