![]() Outline of Bank account control module

Outline of Bank account control module

![]() Outline of Bank account control module

Outline of Bank account control module

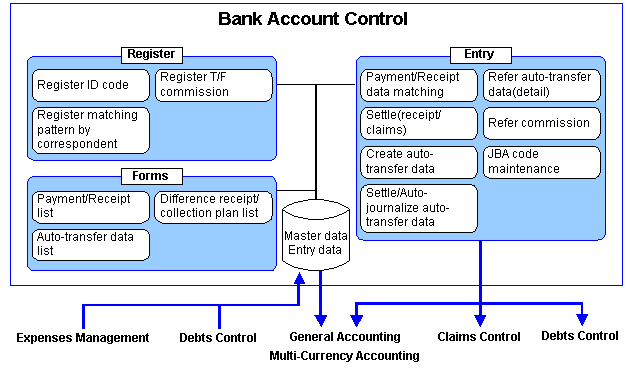

[Bank account control module] under [Finance Subsystem]

is a module used to exchange data with financial institutions.

Payment/Receipt data is received from financial institutions and is imported

into A.S.I.A. to perform matching settlement (identification and summarization)

against Collection plan data. Also

T/F request files are created from an A.S.I.A. Payment plan for financial

institutions. Settlement of created

T/F data is handled within [Bank account control module].

Further, maintenance of JBA codes used by A.S.I.A. is performed including registration and update.

Linkage and processing of operations of menu items are as follows.

[Payment/Receipt data matching → Settle (receipt/claims) processing]

[Payment/Receipt data matching] imports Payment/Receipt files concerning own bank account distributed by financial institutions, and performs identification of ID codes and pattern matching of each Customer/Bank account (identification and summarization). It is also possible to enter Payment/Receipt data directly without importing any file. Matching settlement of Claims collection plan data is carried out based on receipt data which have been taken in by file import or have entered directly.

|

Menu |

Process |

|---|---|

|

This process reads Payment/Receipt files (Received files) from banks and performs identification of ID codes and matching between T/F applicant names and bank accounts of correspondents (identification and summarization). |

|

|

This process

performs matching between data imported by [Payment/Receipt

data matching] and Claims/Collection plan data. Example of journalizing: Bank deposit/Account receivable |

[Auto-transfer request processing → Settle debts/Auto-journal processing]

Data for which settle method is entered with "Auto-transfer" is extracted from payment plan data which is entered from [Debts entry], [Purchase entry], [Repayment commit entry], [Lease payment commit entry], or [Create expenses management data], and T/F request file (JBA format) is created. At this time, T/F commission can be subtracted and paid by correspondent. After it is reported by financial institution that actual T/F payment has been correctly processed, settle (commit) of target data is processed. Auto-journal process is carried out at the same time.

|

Menu |

Process |

|---|---|

|

According to payment plan data such as Debts/Payment plan, this menu creates auto-transfer data to be provided to a bank that will perform auto T/F. |

|

|

After auto-transfer is executed by the bank, settlement of debts/payment plan data of T/F object is processed based on auto-transfer request data. Also, auto-journal process is performed at the same time. Example of journalizing: Account payable/Bank deposit |

![]() Menu structure

Menu structure

[Bank account control module] can output the following forms:

|

Forms |

Comment |

|

This form is used to output checklist of payment/receipt data. |

|

|

This form is used to output checklist of

auto-transfer data. |

|

|

This form is for summary of matching target data. Simulation prior to execution of settlement can be performed. |

Refer to here for Output of Forms.