![]() Register A/C and Sub A/C

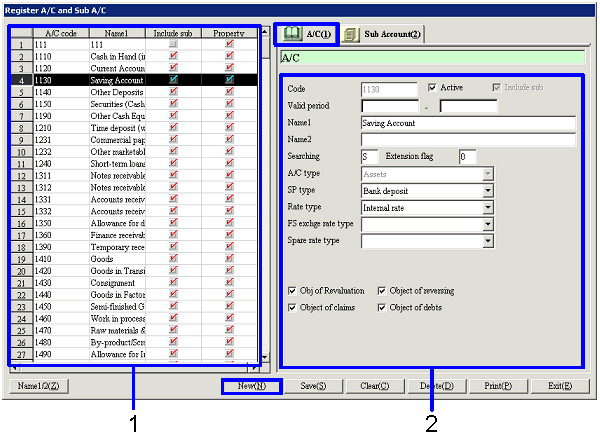

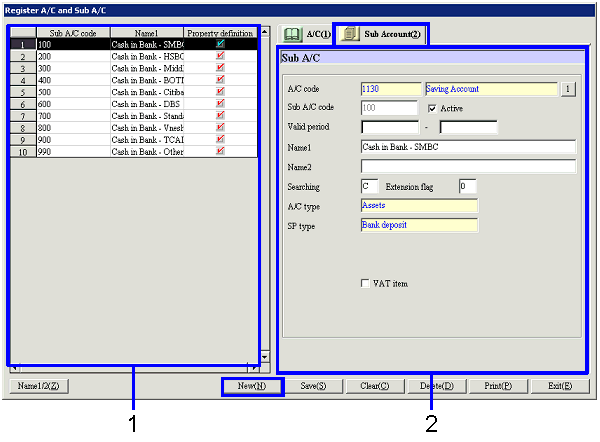

Register A/C and Sub A/C

The process registers

A/C and sub A/C for use in A.S.I.A.

Irrespective of whether A/C and sub A/C are registered, they cannot be

used unless they are set for property.

Therefore, you must register A/C property in [Register A/C property].

→ A/C

![]() Screen Transition

Screen Transition

[Master management]

↓

[Accounting master]

↓

[Accounting management]

↓

[Register A/C and Sub A/C]

↓

[Register A/C and Sub A/C] screen → [A/C], [Sub A/C] tab

![]() Item Setup

- [A/C] tab

Item Setup

- [A/C] tab

|

Dr/Cr |

A/C type |

|

Dr Balance A/C |

Assets |

|

Cost of sales |

|

|

Sales and general |

|

|

Non-operating expenses |

|

|

Extraordinary loss |

|

|

Profit adjustment (P/L) |

|

|

Cr Balance A/C |

Liability |

|

Capital |

|

|

Sales |

|

|

Non-operating profit |

|

|

SP gain |

|

Setup, Entry |

Selectable SP Type of A/C |

|

Setup of cash A/C and sub A/C in [Parameter Setup] |

Cash |

|

Setup of A/C and sub A/C for each bank account in [Register bank account] |

Bank deposit |

|

Entry of Dr A/C in [Receiving voucher] and Cr A/C in [Payment voucher] in [General accounting/multi-currency accounting module] |

Cash, bank deposit |

|

Range of A/C and sub A/C for output in [Cash daybook (standard/by currency)] and [Bank daybook (standard/by currency)] in [General accounting/multi-currency accounting module] |

Cash, bank deposit |

|

A/C and sub A/C for which entry is prohibited if "Transfer voucher cash entry prohibit" is set On with [Transfer voucher (std/foreign currency)] in the [General accounting/multi-currency accounting module] |

Cash, bank deposit |

|

Cr A/C (Sales A/C, Purchase Return A/C, Out Cr Temporary A/C) in the cost of sales method when inventory auto-journalizing |

Inventory |

|

Presently unused |

Monetary assets, monetary debts |

|

Dr A/C (Sales Return A/C, Purchase A/C, Incoming Dr Temporary A/C) in the cost of sales method when inventory auto-journalizing |

Inventory |

|

A/C to use if there is a negative difference in the implemented inventory |

Inventory |

|

Cost A/C for cost of sales |

Inventory |

|

Used in the [Fixed assets module] |

Fixed assets |

|

Used in the [Construction in progress module] |

Construction in progress account |

|

Currently unused |

Deferred assets |

|

Used in the [Deferred accounts control module], [Uncollected control module] and [Unpaid control module] |

Prepaid expenses, deferred revenue |

|

Setup of the previous year profit carry-forward A/C in [Annual closing parameter setup] in the [Closing control module] |

Previous year profit carry-forward (one A/C only) |

|

A/C to use for commission A/C in the [Notes receivable module] when auto-journalizing |

Commission paid |

|

A/C to use for exchange gain and loss A/C in the [Multi-currency accounting module] when evaluating FC |

Exchange loss, exchange gain |

|

A/C to use for exchange gain and loss A/C in the [Claims control module] and [Debts control module] when settling or auto-journalizing |

Exchange loss, exchange gain |

|

A/C to use for entering VAT in the [Bank account control module] |

Dr side VAT, Cr side VAT |

|

Use in the [Leased assets module] |

Lease |

|

FS Exchange Rate Type |

Use |

|

Rate at acquisition |

Use the rate at acquisition as the exchange rate when creating financial statements. |

|

Rate at settlement |

Use the rate at settlement as the exchange rate when creating financial statements. |

|

Average rate |

Use the average rate during the term as an exchange when creating financial statements. |

![]() Buttons

Buttons

![]() Notes:

Notes: