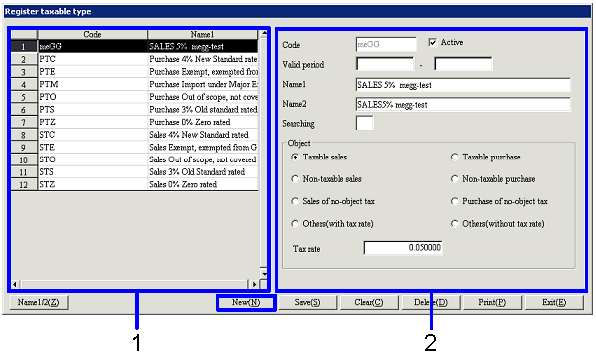

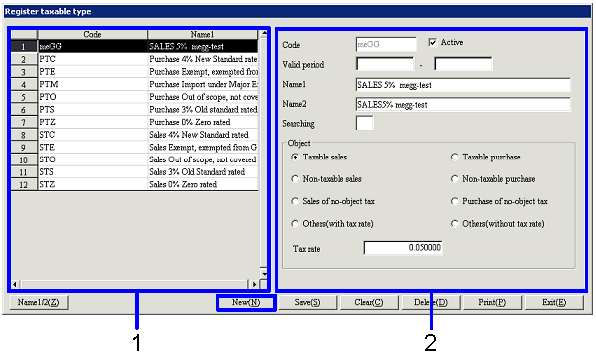

Register taxable type

Register taxable type

Register taxable types of VAT. Specifying taxable types for voucher

entry, sales subsystem, purchase subsystem, claims control module, debts

control module, etc. allows automatic calculation of taxes.

Setting "VAT control (accounting)" of [Parameter setup]

to "Yes" makes it possible to enter taxable types and taxes with vouchers,

which allows creation of basic data for VAT declaration from [VAT summary sheet

by taxable type] and [VAT detailed sheet by taxable type].

→ To Concept

of tax control with A.S.I.A.

Screen Transition

Screen Transition

[Master management]

↓

[Common master]

↓

[Other management]

↓

[Register taxable type]

↓

[Register taxable type] screen

Item Setup

Item Setup

- Select taxable type (or

register new taxable type)

Taxable types that have been registered are

listed. Select the taxable type to

set up. The information on the

taxable type selected is displayed on the Details tab.

To register a new taxable type, click the "New" button.

-

Code, name

The code and name of the taxable type are displayed.

- Enter details

-

Code

Enter a code for the taxable type. Up to 20 English one byte characters can be entered.

-

Active

-

Term of

validity

-

Name 1, 2

-

Searching

-

Object

Select a taxable type from the following options: "Taxable sales," "Taxable

purchase," "Non-taxable sales," "Non-taxable purchase," "Sales of no-object

tax," "Purchase of no-object tax," "Others (with tax rate)," "Others (without

tax rate)."

The type set here narrows down the taxable types displayed as options on the

entry screen. For example, taxable

types for purchase are not displayed in the sales subsystem.

-

Tax rate

Enter a tax rate only if "Taxable sales," "Taxable

purchase," or "Others (with tax rate)" has been selected with "Object."

Buttons

Buttons

![]() Register taxable type

Register taxable type![]() Screen Transition

Screen Transition![]() Item Setup

Item Setup

![]() Buttons

Buttons