![]() Procedure for register debts pattern

Procedure for register debts pattern

![]() Function Outline

Function Outline

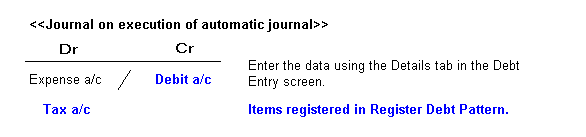

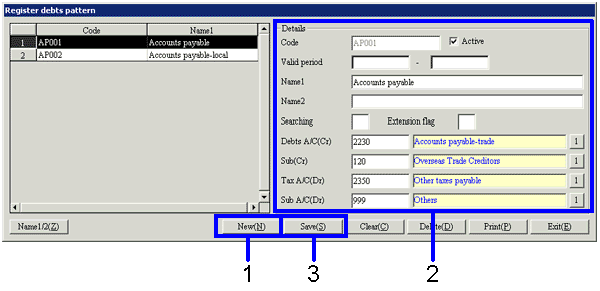

Register a new registration of [Debts A/C (Payment Plan)] and [Tax A/C (Details)] and modify such a combination in [Register debts pattern].

The debt patterns registered here may be called up in the [Debt pattern] on the [Header] tab in the [Debts entry] screen.

![]() 1. Screen Display Method

1. Screen Display Method

![]() 2. New Registration

2. New Registration

→To Menu Reference

Note

Where a debt pattern is set up originally due to the addition of the sub a/c, note that, unless the set of the tax a/c (dr) and the VAT a/c matches the sub a/c master setup for sales tax/purchase tax in the debts a/c (main a/c), there will be a gap between the VAT detail table and the VAT a/c balance.

![]() 3. Modify

3. Modify