![]() Concept of fraction adjustment in A.S.I.A.

Concept of fraction adjustment in A.S.I.A.

![]() Outline

Outline

When an amount is input on the A.S.I.A. screen

in standard currency or the entry currency, the tax amount is calculated

according to the tax rate and tax type (internal/external), which are setup for

taxable types. At that time, the

fraction process is different depending on the amount and the currency.

The following shows related settings.

Refer to detailed calculation procedures for internal/external taxes in the [Concept of VAT control in A.S.I.A.].

![]() Fraction

adjustment (sales/purchase tax)

Fraction

adjustment (sales/purchase tax)

The tax fraction adjustment method is selected

from "Revaluate," " Omit" and "Round off."

The fraction adjustment method is set for sales tax (accounting subsystem,

claims subsystem, sales control subsystem) and purchase tax (accounting

subsystem, debt subsystem, purchasing control subsystem). When setting the

[Parameter setup] from

the [System custodian module], the following applies to the sales/purchase tax

process.

![]() Deferred

tax accounting fraction adjustment

Deferred

tax accounting fraction adjustment

The fraction adjustment method with the legal effective tax rate for deferred tax accounting is set in the [Parameter setup] from the [System custodian module] separately from the above.

![]() Fraction

adjustment (FC)

Fraction

adjustment (FC)

When calculating with a foreign currency, the

standard amount is calculated automatically and select the fraction adjustment

method from "Revaluate," "Omit," and "Round off."

When setting the [Parameter setup] from the [System custodian module], it

applies to calculation of all foreign currency.

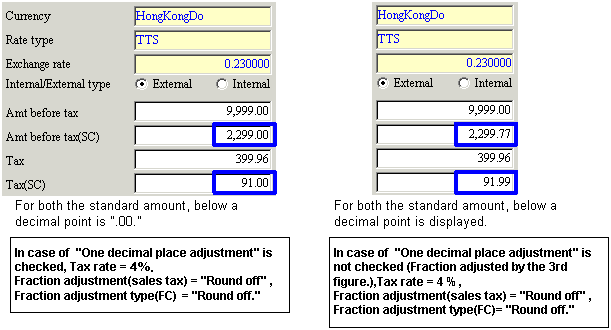

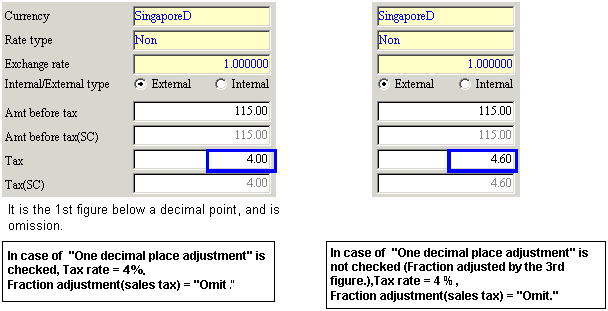

![]() One

decimal place adjustment

One

decimal place adjustment

When a currency that does not use numbers after the decimal like Japanese yen becomes a standard currency, it is possible to set foreign currency fraction adjustment, which is done in the first decimal place.

The following shows a fraction adjustment

sample for standard currency conversion and standard tax amount conversion when

entering uncollected control module claims.

When setting the [Company setup] from the [System custodian module], it applies not only to all foreign currency conversion for the standard amount, but also applies to the decimal place of fraction adjustment for the following amount calculations (only when the currency is a standard currency).

![]() Fraction

adjustment for the amount pro rata from the absorption processing module

Fraction

adjustment for the amount pro rata from the absorption processing module

A fraction that is from when the absorption amount is calculated for each detailed row of the absorption journal is adjusted by selecting the fraction adjustment method (one from "Revaluate," "Omit," "Round off") on the [Absorption journal] tab of the [Register absorption pattern]. The difference from the fraction adjustment is adjusted in row No.1 of the absorption standard.