Procedure for T/F voucher entry

Procedure for T/F voucher entry

Outline

Outline

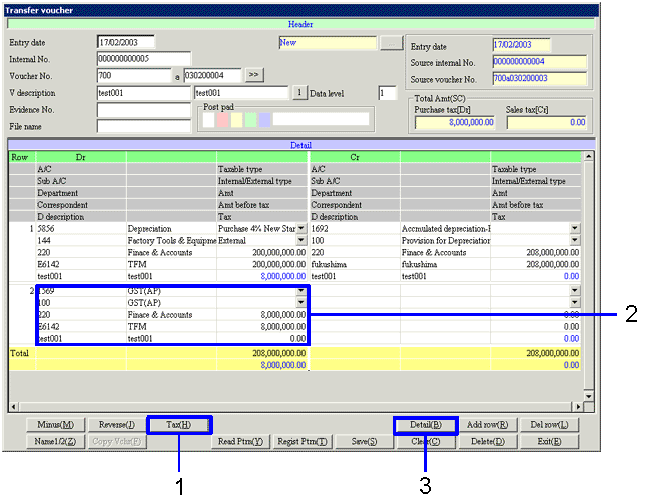

On the screen, the journal data consists of debits on the left side and credits on the right side. The Project code and Accounting analysis code will be entered in each journal detail. By clicking the "VAT" button, the tax amount will automatically be calculated.

1. Screen Display Method

1. Screen Display Method

- Select: [Standard Accounting] → [General Accounting] → [Entry]

- From the menu, choose [T/F

Voucher]

→ [T/F voucher] screen

2. Journal Entry

2. Journal Entry

→To Menu Reference

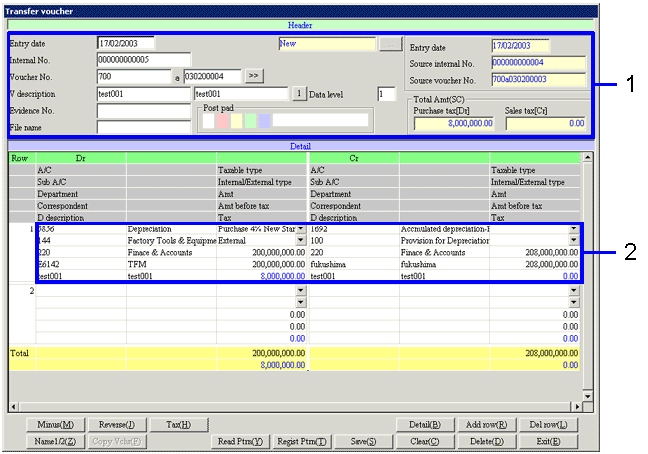

- Enter the Header information (Entry date, Voucher No., etc.).

You can make an entry for

the items that appear in white. Double-click on the entry items so that you can select a value from a pop-up screen.

- Enter journal data (A/C, Sub A/C, Department, Correspondent, Detail description, Taxable Type, Internal/External type, Amt, Amt before tax, Tax).

Enter the Amt and Tax in one-byte characters. Amounts before tax are automatically displayed and you cannot modify them. In the Spreadsheet, double-click on the entry items so that you can select a value from a pop-up screen.

3. Tax Entry

3. Tax Entry

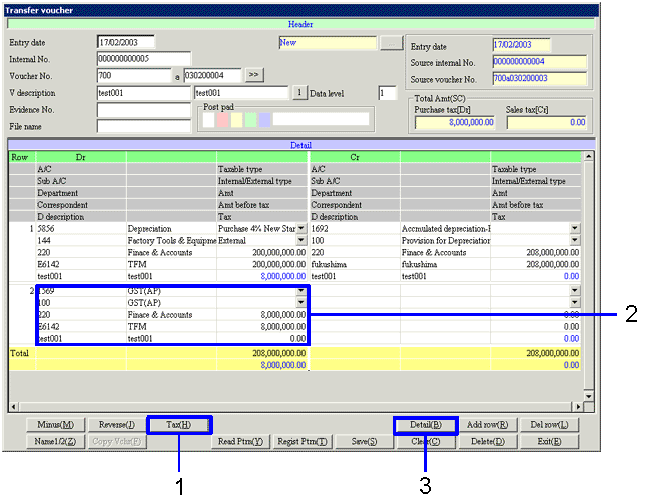

- Click on the "Tax (H)" button.

- The VAT journal is automatically set up.

- After tax entry is completed, click on the "Detail (B)" button.

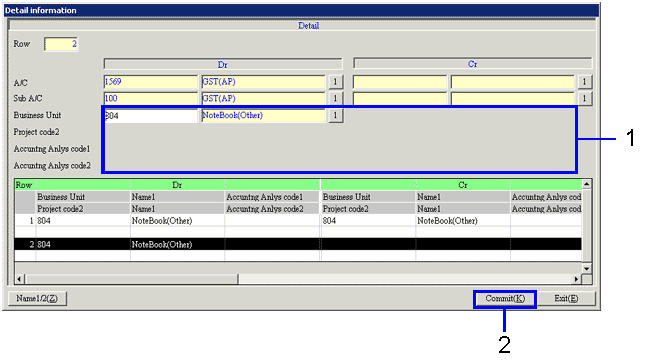

→ The [Detail information] screen now appears.

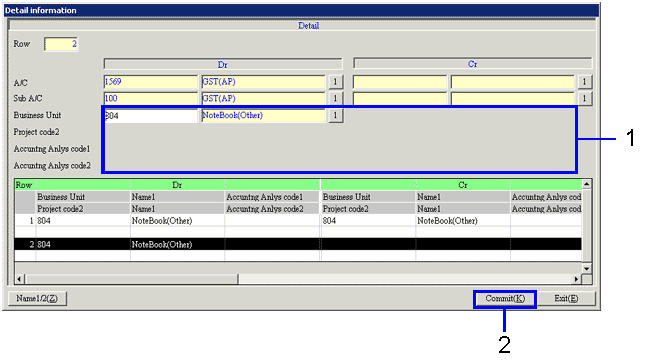

* For the [Detail information] screen, some items must be entered. If there is no entry for these items, you cannot save the data, even clicking the "Save (S)" button. A cursor would automatically move on the "Detail (B)" button to ask you to click on.

4. Detail Entry

4. Detail Entry

→To Menu Reference

- Enter the Project code and/or Accounting analysis code in the Details. The Items to be

entered appear in white. Entry is required for the items that have the name display on the right side.

- After entering Dr/Cr items in each detail, click the "Commit (K)" button.

back to the [T/F voucher] screen. Now click the "Save (S) " button.

5. When an Error Occurs

5. When an Error Occurs

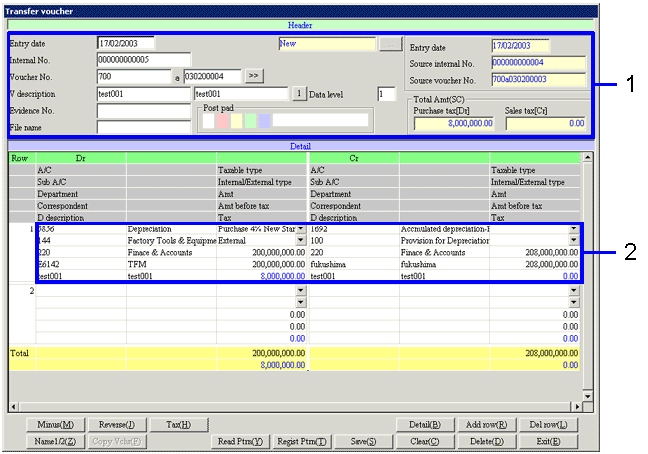

- Error 1 : If Dr/Cr balance do not match.

After clicking the "Save (S)" button, an error message appears when Dr/Cr is not balanced, so you cannot save the data.

→ This happens when you missed to click the "Tax (H)" button.

- Error 2 : If entry is incomplete for the entry-required items.

An error message says that there is no entry for the entry-required items with reference to the account property, and a cursor moves to the items of which entry is missing.

![]() Procedure for T/F voucher entry

Procedure for T/F voucher entry![]() Outline

Outline![]() 1. Screen Display Method

1. Screen Display Method![]() 2. Journal Entry

2. Journal Entry

![]() 3. Tax Entry

3. Tax Entry

![]() 4. Detail Entry

4. Detail Entry

![]() 5. When an Error Occurs

5. When an Error Occurs