Procedure for Auto-journalize prepaid expenses depreciation, auto-journalize

deferred revenue depreciation

Procedure for Auto-journalize prepaid expenses depreciation, auto-journalize

deferred revenue depreciation

Outline

of function

Outline

of function

You can execute auto-journalize depreciation for

prepaid expenses/deferred revenue.

Note that it cannot be executed unless the accounting closing is not

completed before the previous term.

The same auto-journalize depreciation method can apply for both prepaid

expenses and deferred revenue.

This sectionl explains the auto-journalize depreciation method with the

example of deferred data (prepaid expense).

1.

Screen display method

1.

Screen display method

- Select [Additional accounting] → [Deferred account control] → [Execute].

- Select [Auto-Journalize Prepaid Expenses Depreciation] from the

menu.

→ When deferred revenue is the object, select [Auto-journalize

deferred revenue depreciation].

2.

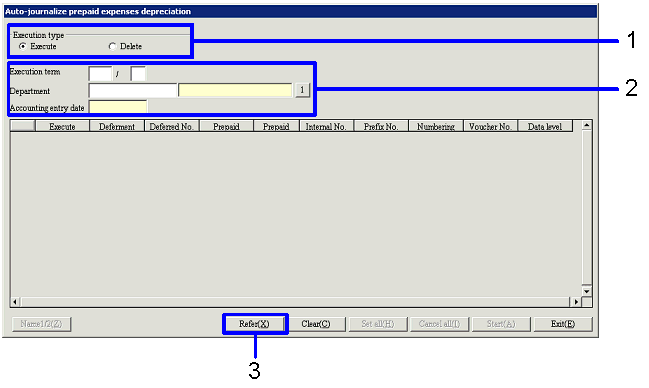

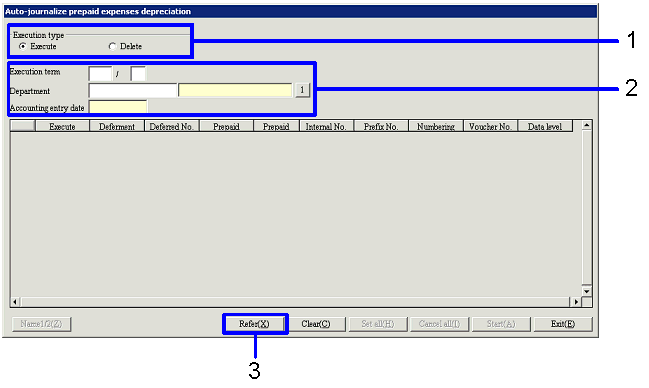

Refer auto-journalize prepaid expenses depreciation data

2.

Refer auto-journalize prepaid expenses depreciation data

→ To Menu Reference

- Select the execution type from "Execute" or "Delete." The default displays "Execute." Select "Delete" when delete journal

data.

- Enter the searching condition ("Execution term," "Department,"

"Accounting entry date").

- Click the "Refer" button.

→ Searching results will be displayed in [Spread].

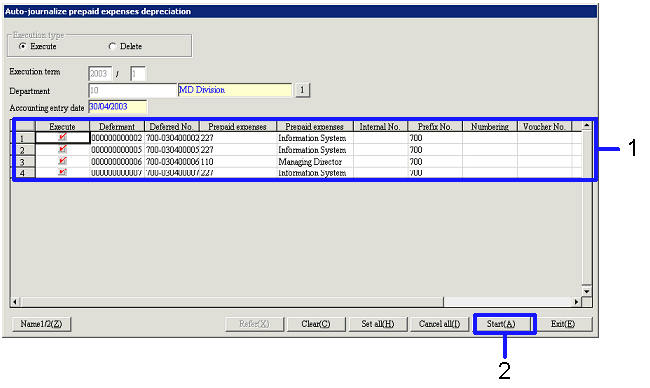

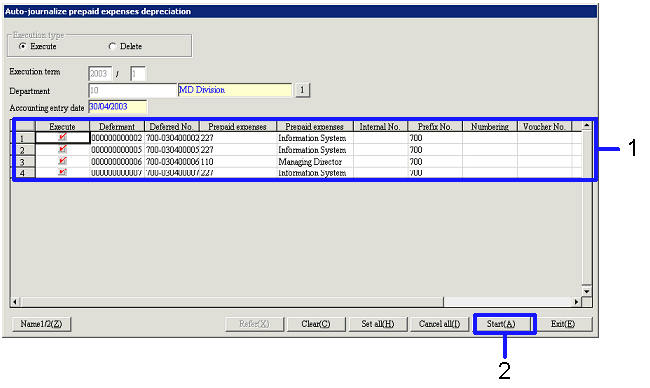

3.

Start auto-journalize prepaid expenses depreciation

3.

Start auto-journalize prepaid expenses depreciation

- Check the "Execute" boxes of the object data for auto-journal. Click the "All set" button,

and the "Execute" check boxes for all data displayed in [Spread] will be

ON. On the other hand, click the "Cancel

all" button, and the "Execute" check boxes for all data displayed in

[Spread] will be OFF.

- Click the "Start" button.

→ Auto-journalize depreciation will be

executed.

![]() Procedure for Auto-journalize prepaid expenses depreciation, auto-journalize

deferred revenue depreciation

Procedure for Auto-journalize prepaid expenses depreciation, auto-journalize

deferred revenue depreciation![]() Outline

of function

Outline

of function![]() 1.

Screen display method

1.

Screen display method![]() 2.

Refer auto-journalize prepaid expenses depreciation data

2.

Refer auto-journalize prepaid expenses depreciation data

![]() 3.

Start auto-journalize prepaid expenses depreciation

3.

Start auto-journalize prepaid expenses depreciation