Procedure for Receiving/Payment voucher entry

Procedure for Receiving/Payment voucher entry

Outline

Outline

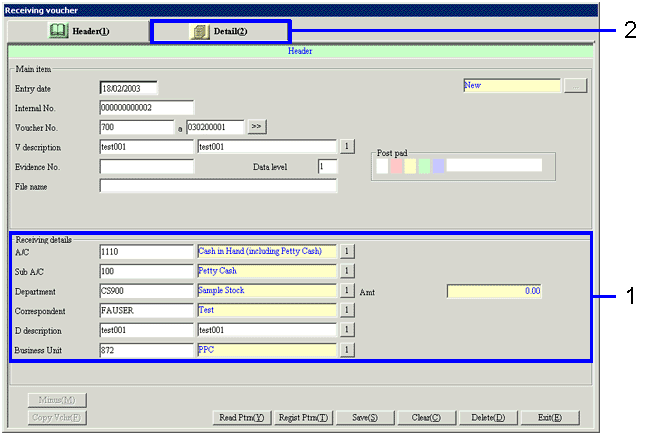

On the [Receiving voucher] screen or the [Payment voucher] screen, you enter Receipt/Payment contents in the Detail tab and then enter the details of the Cr/Dr account. Tax is automatically calculated by clicking the "Tax" button.

1. Screen Display Method

1. Screen Display Method

- Select [Standard Accounting] → [General Accounting] → [Entry]

- From the menu, select [Receiving Voucher] or [Payment Voucher]

→ [Receiving voucher] screen or [Payment voucher] screen

2. Entering Receipt/Payment Contents

2. Entering Receipt/Payment Contents

→To Menu Reference

- Enter Receipt/Payment contents.

- When the entry is completed, click the "Detail" tab.

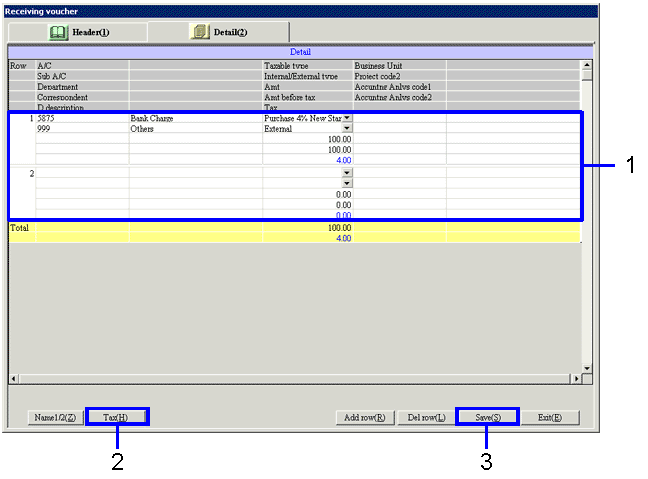

3. Detail Entry, Tax, Save

3. Detail Entry, Tax, Save

→To Menu Reference

- Enter the contents on the Cr

account for Receiving or the Dr account for Payment, as well as the Project code and Accounting analysis code for each detail.

- After entering the items for each detail, click the "Tax (H)" button.

→ VAT Journal will automatically be set.

- Click the "Save (S)" button.

4. When an Error Occurs

4. When an Error Occurs

- When entry is incomplete

in the entry-required items.

An error message says that there is no entry in the entry-required items with reference to the account property, and a cursor moves to the items of which entry is missing.

![]() Procedure for Receiving/Payment voucher entry

Procedure for Receiving/Payment voucher entry![]() Outline

Outline![]() 1. Screen Display Method

1. Screen Display Method![]() 2. Entering Receipt/Payment Contents

2. Entering Receipt/Payment Contents![]() 3. Detail Entry, Tax, Save

3. Detail Entry, Tax, Save![]() 4. When an Error Occurs

4. When an Error Occurs