Procedure for Deferred account entry (prepaid expenses, deferred

revenue)

Procedure for Deferred account entry (prepaid expenses, deferred

revenue)

Outline

Outline

You can enter deferred data (prepaid expenses,

deferred revenue). The same entry

method can apply for both prepaid expenses and deferred revenue. This section explains the entry method

with the example of deferred data (prepaid expense).

1.

Screen display method

1.

Screen display method

- Select [Additional Accounting] → [Deferred account control] → [Entry].

- Select [Deferred Account Entry (Prepaid Expense)] from the

menu.

→ When entering the deferred data for deferred revenue, select [Deferred

receipt (deferred revenue)].

2.

Deferred account entry

2.

Deferred account entry

→ To Menu Reference

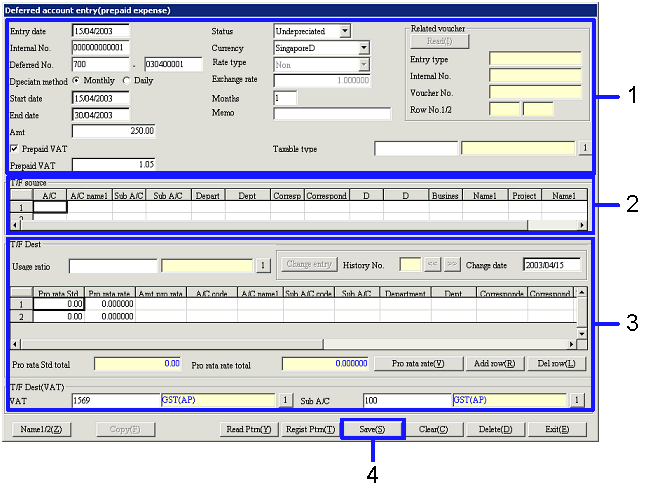

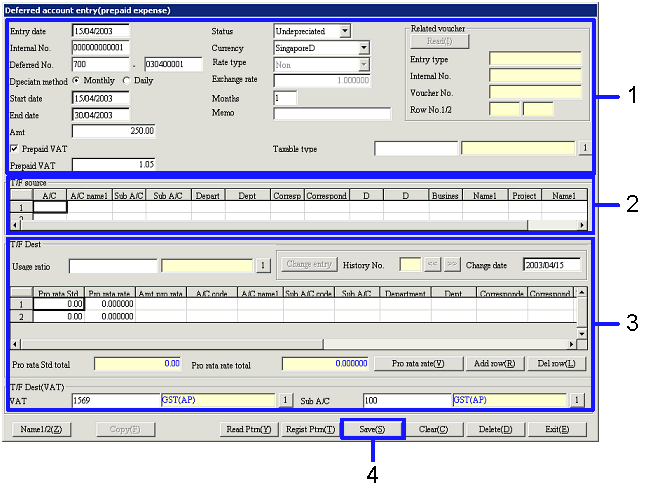

- Enter the header information (Entry date, Start date, End date, Depreciation

method, etc.).

When entering prepaid VAT, mark the "Prepaid VAT" check box and enter each item

in "Prepaid VAT" ("Prepaid VAT" is displayed only when the "Prepaid

VAT" check box is ON.)

When you make new deferred account entry, no data will be displayed in "Related

voucher," not to allow you to use the "Read" button. When the deferred account entry screen

was activated from debts (detail), click the "Read" button in "Related

voucher," data information that is specified as deferred objects for debts

(Entry type, Internal No., etc.) will be displayed.

- Enter the prepaid expense information in "T/F source."

When entering prepaid VAT, enter the prepaid VAT information in the 2nd

row.

- Enter the payment party in "T/F Dest" when depreciation is

executed.

When entering prepaid VAT, make sure if the "Prepaid VAT" check box is ON and enter

each item in "T/F Dest (Temp S order VAT)."

- Click the "Save" button.

→ For deferred data (deferred revenue), VAT is "Prepaid

VAT" and related voucher is "Claims related voucher." In "T/F source," enter prepaid

VAT information. In "T/F Dest,"

enter the receipt destination.

Change

for registered data

Change

for registered data

On undepreciated data, directly enter the item

on the screen to change the data.

On depreciated data, click the "Change entry" button to change T/F

method.

Registered

data confirmation

Registered

data confirmation

For data registered in deferred account entry (prepaid

expense) can be confirmed in Depreciation schedule list (prepaid

expenses).

For data registered in deferred account entry (deferred revenue) can be

confirmed in Depreciation

schedule list (deferred revenue).

![]() Procedure for Deferred account entry (prepaid expenses, deferred

revenue)

Procedure for Deferred account entry (prepaid expenses, deferred

revenue)![]() Outline

Outline![]() 1.

Screen display method

1.

Screen display method![]() 2.

Deferred account entry

2.

Deferred account entry

![]() Change

for registered data

Change

for registered data![]() Registered

data confirmation

Registered

data confirmation