Procedure for Fixed assets disposal

Procedure for Fixed assets disposal

Outline

Outline

In [Fixed assets disposal], the Fixed assets

data to be disposed is extracted and the disposal process is executed. The depreciation method can be

specified for each layer such as "Monthly pay method" and "Closing book value

method."

1.

Screen display method

1.

Screen display method

- Select [Assets] → [Fixed Assets] → [Entry].

- Select [Fixed assets disposal] from Menu.

→ The [Fixed assets disposal] screen will appear.

2.

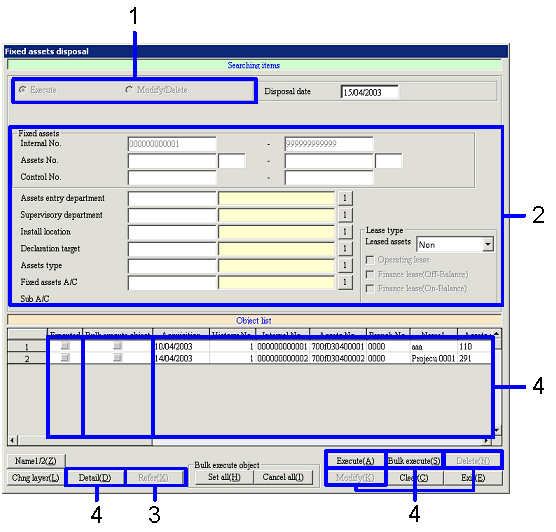

Searching for and entering Disposal Object

2.

Searching for and entering Disposal Object

→ To Menu Reference

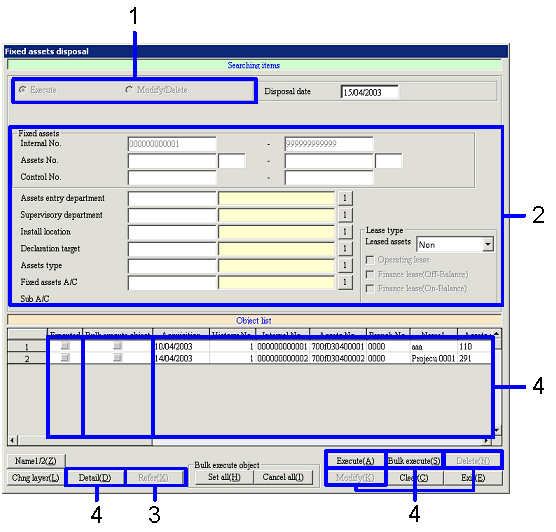

- Select "Execute" or "Modify/Delete" in "Type."

If you choose "Modify/Delete" is selected, select "Auto-journal object" or "No

auto-journal."

- After entering necessary items, enter the fixed assets data

Searching Range.

To search for "Auto-journal object" data, enter Voucher data to be processed.

- Click on the "Refer(X)" button.

A list of fixed asset data searched for is displayed in [Object list].

- Depending on the process, click on one of the following buttons;

- To confirm registered contents, select

applicable fixed assets data and click on the "Detail (D)" button.

→ The [Fixed assets details display] screen will appear.

-

To execute the disposal process or

make modification for certain fixed assets data in [Object list], select

applicable fixed assets data and click on the "Execute(A)" button for disposal

or the "IndivModifying(K)" button for modification.

→ The [Fixed assets disposal] screen will appear for the disposal

process and the [Modify fixed assets disposal] screen for modification.

-

To collectively execute the disposal

process or make modification for fixed assets data in [Object list], click on

the "Bulk Execute(S)" button for the disposal process or the "BulkModifying(S)"

button for modifying with the "Bulk Execute object" checkbox ON for the fixed

assets data.

→ The [Bulk fixed assets disposal] screen will appear. Basic operations of the [Bulk fixed

assets disposal] screen are the same as those of the [Fixed assets disposal]

screen.

-

To delete fixed assets data in [Object

list], select applicable fixed assets data and click on the "Delete(N)" button.

→ The fixed assets data will be deleted.

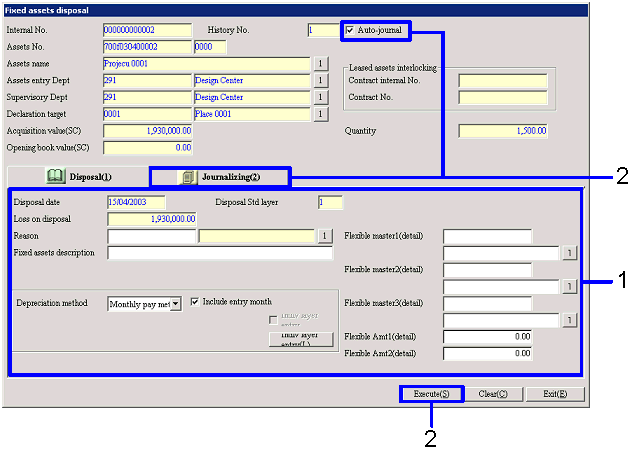

3.Registering

Disposal Information

3.Registering

Disposal Information

→ To Menu Reference

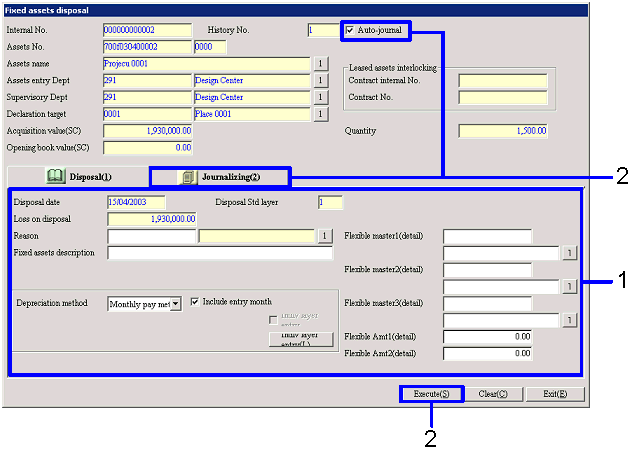

- Enter necessary disposal information (Reasons, etc.).

A depreciation method can be selected for each layer.

- Select whether to include the data in Auto-journalization. Depending on the status of the "Auto-journal

object" checkbox, perform the following operations;

- If the "Auto-journal object" checkbox

is ON, click on the [Journalizing] tab.

→ The [Journalizing] tab will appear.

- If the "Auto-journal object" checkbox

is OFF, click on the "Execute(S)" button.

→ The Disposal process is completed, and the [Fixed assets disposal(Searching

items, Object list)] screen will appear.

For disposed fixed assets data, the "Executed" checkbox in [Object list]

is checked.

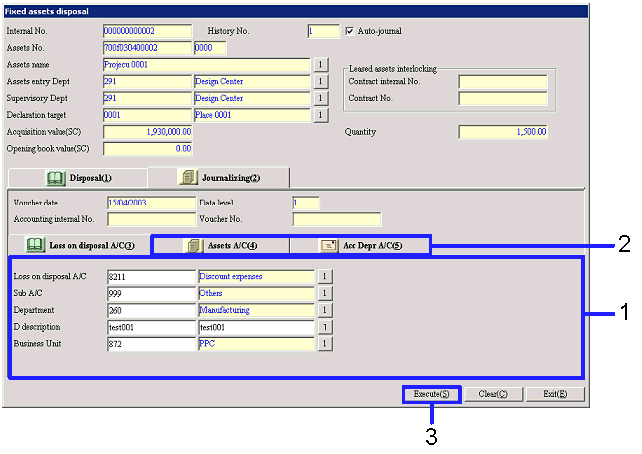

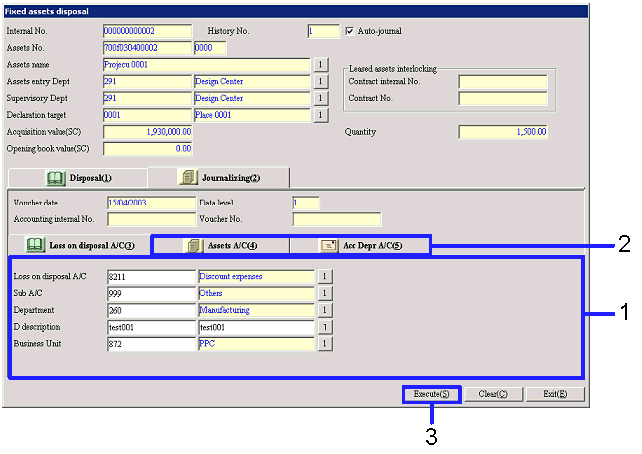

4.Registering

Loss of disposal A/C, Assets A/C, Depreciation total Amt A/C

4.Registering

Loss of disposal A/C, Assets A/C, Depreciation total Amt A/C

→ To Menu Reference

- Enter Loss of disposal A/C.

- Enter Journalizing information on the

[Assets A/C] and [Depreciation Total A/C] tabs if necessary.

- Click on the "Execute(S)" button.

→ The [Transfer

voucher] screen will appear, and Auto-journal is executed.

If

the "Execute(S)" button is clicked on the [Transfer

voucher] screen, the [Fixed assets disposal (Searching

items and Object list) screen will appear. The "Executed" checkbox in [Object list] is checked for

fixed assets data for which the Disposal process has been executed.

![]() Procedure for Fixed assets disposal

Procedure for Fixed assets disposal![]() Outline

Outline

![]() 1.

Screen display method

1.

Screen display method![]() 2.

Searching for and entering Disposal Object

2.

Searching for and entering Disposal Object

![]() 3.Registering

Disposal Information

3.Registering

Disposal Information

![]() 4.Registering

Loss of disposal A/C, Assets A/C, Depreciation total Amt A/C

4.Registering

Loss of disposal A/C, Assets A/C, Depreciation total Amt A/C