Procedure for Lease contract entry ("Finance lease" and "Off-balance")

Procedure for Lease contract entry ("Finance lease" and "Off-balance")

Outline

Outline

In [Lease contract entry], you can enter lease

contract information on the [Contract information] tab, the [Payment data] tab

and the [A/C and Payment method], using lease transaction types entered as the

master.

The procedure for contract entry varies from the following lease transaction

types.

In this section, we will explain the type of

"Finance lease" and "Off-balance."

You can also register the entered contract information as a pattern. Thus, the registered pattern can be

used as a template to enter lease contract information.

1.

Screen display method

1.

Screen display method

- Select [Assets] → [Leased assets] → [Entry].

- Select [Lease Contract Entry] from the menu.

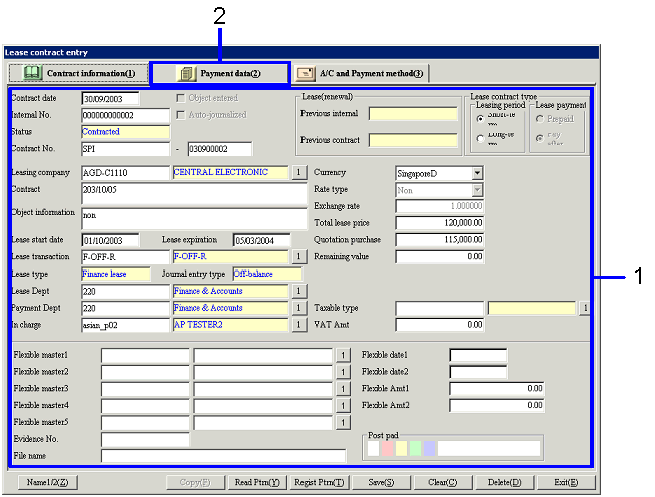

→ The [Contract information] tab of the [Lease contract entry] screen

will appear.

2.

Contract information entry

2.

Contract information entry

→ To Menu Reference

- Enter lease contract information (including contract date, internal

No., leasing company).

- After entering lease contract information, click the [Payment data]

tab.

→ The [Payment data] tab of the [Lease contract entry] screen will

appear.

3.

Payment schedule creation

3.

Payment schedule creation

When you modify "Lease start date,"

"Currency," "Quotation purchase value," "Remaining

value guarantee Amt" and/or "Taxable type" after entering payment

data, the contents on the [Payment data] tab will be cleared. Similarly, when you modify "Lease

transaction type," the contents on the [Payment data] tab and/or the [A/C

and Payment method] tab will be cleared.

→ To Menu Reference

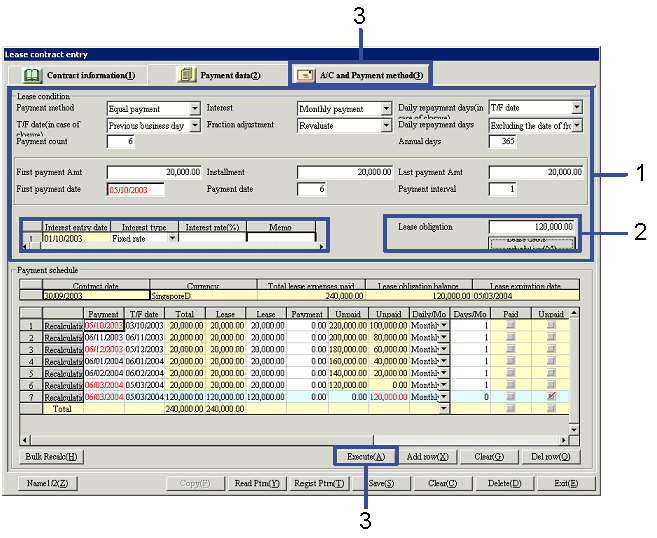

- Enter the lease conditions.

To set up the interest, enter a

value in the [Interest Spread] section.

- Click the "Lease debts calculation" button, and "Discount current

value of total lease price" will be calculated. After the value is compared with "Quotation purchase value"

entered on the [Contract information] tab, the smaller one will be displayed in

"Unpaid lease balance."

-

Click the "Execute (A)"

button.

→ Lease payment schedule information will be displayed in the

[Payment schedule] section.

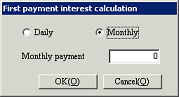

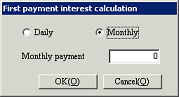

When "Interest" indicates "Monthly payment," click the "Execute

(A)" button to display the [First payment interest calculation] screen.

After selecting "Daily payment" or "Monthly payment" for calculating first

payment interest and entering "Daily repayment days" or "Monthly

payment months," click the "OK (O)" button.

→ Payment interest will be calculated.

When you modify the lease condition after executing the process, click the

"Execute (A)" button again to display the [Refresh payment schedule]

screen.

Make an entry in the first spread line with which you start to modify the

payment schedule and then click the "OK (O)" button. Payment schedule will be recreated for

the remaining lines after the selected row.

-

Confirm the lease payment schedule

information and click the [A/C and Payment method] tab.

→ The [A/C and Payment method] tab of the [Lease contract entry]

screen will be displayed.

4.

A/C and Payment method entry

4.

A/C and Payment method entry

→ To

Menu Reference

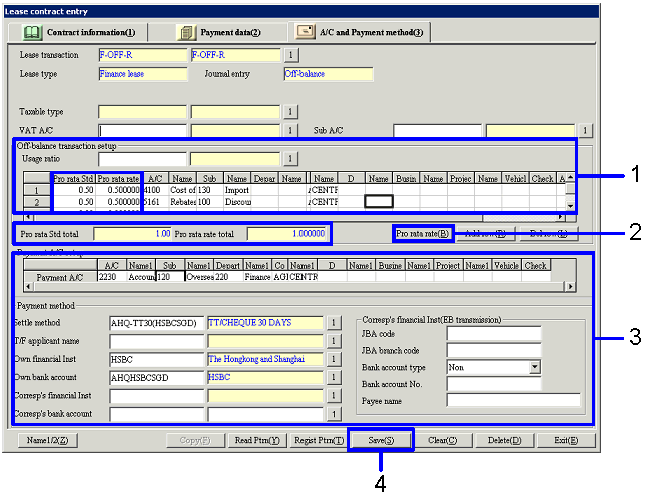

-

Set up off-balance transaction

information.

You can also select the

registered "Usage ratio."

-

Click the "Pro rata rate

(B)" button.

→ Calculation will be made so that "Pro rata rate total"

indicates "1" based on "Pro rata Std."

-

Enter payment A/C information and

payment method.

-

Click the "Save (S)"

button.

![]() Procedure for Lease contract entry ("Finance lease" and "Off-balance")

Procedure for Lease contract entry ("Finance lease" and "Off-balance")![]() Outline

Outline![]() 1.

Screen display method

1.

Screen display method![]() 2.

Contract information entry

2.

Contract information entry![]() 3.

Payment schedule creation

3.

Payment schedule creation

![]() 4.

A/C and Payment method entry

4.

A/C and Payment method entry