Register correspondent

Register correspondent

Register correspondents to control with A.S.I.A.

→ Correspondent

Screen Transition

Screen Transition

[Master management]

↓

[Common master]

↓

[Trade management]

↓

[Register correspondent]

↓

[Register correspondent] screen – [Details

1] tab, [Details 2] tab, [Details 3]

tab, [Details 4] tab, [Sales/Purchase 1]

tab, [Sales/Purchase 2] tab, [Additional

information] tab

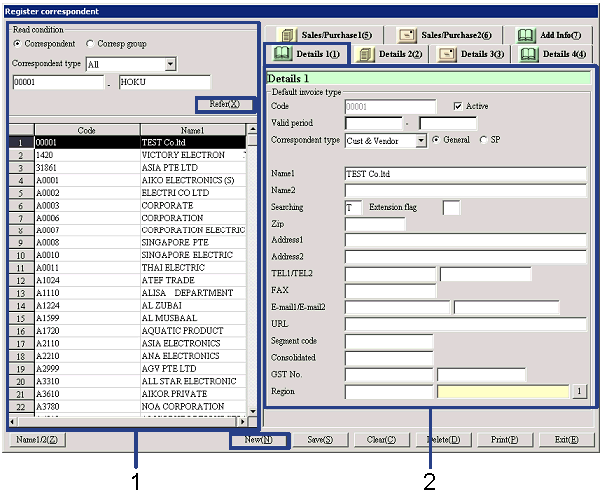

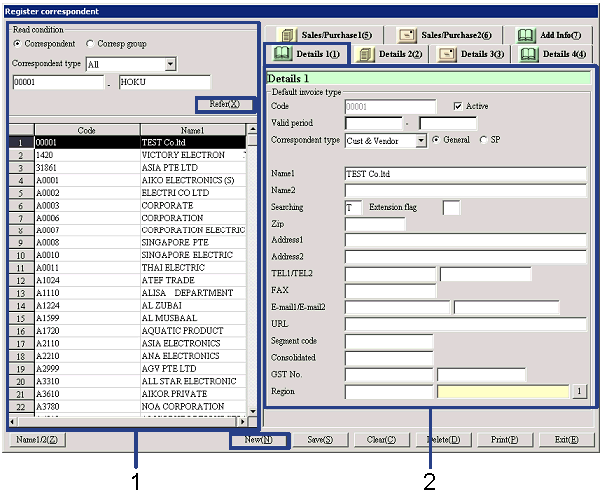

Item Setup - [Details 1] tab

Item Setup - [Details 1] tab

- Select correspondent (or

register new correspondent)

Clicking the "Reference" button lists the

correspondents that meet the read conditions. Select the correspondent to set up. The information on the correspondent

selected is displayed on the [Details 1] tab.

To register a new correspondent, click the "New" button.

-

Correspondent, correspondent group,

code

Select conditions to read the correspondents to register

or refer to.

Correspondent:

Select this to directly search for a correspondent. A range of correspondent codes can be

specified.

Correspondent group:

Select this option to select a correspondent group and specify a correspondent

for which structure is registered in the correspondent group.

-

Correspondent type

Select the type of correspondent to refer to from the following options: "All," "Vendor,"

"Cust," "Cust & Vendor," "Related company." This is displayed only when the

specified range is "Correspondent."

-

Code

Select the code according to the selection of "Correspondent"/"Correspondent

group" and "Correspondent type."

-

Code, name

The codes and names of the correspondents that meet

the read conditions are displayed.

- Enter details (1)

-

Code

Up to 20 English one byte characters can be entered. Note that codes that coincide with employee

codes or financial institution codes cannot be registered.

When the "Also register as delivery to" check box is checked on the [Sales/Purchases

2] tab and saved, the codes entered here are copied to [Register delivery to] of

[Logistics master module]. If a

correspondent "also registered as delivery to" is deleted, the code specified

remains as an item of registration as a correspondent and the same code cannot

be used for "Also register as delivery to." The corresponding delivery destination must be deleted in [Register

delivery to].

-

Active

-

Term of

validity

-

Correspondent

type

-

General, SP

Specify whether the importance of this

correspondent is "General" or "SP."

This can be used as a key for searching sales order data or shipping

order data or outputting lists in [Sales

subsystem].

-

Name 1, 2

-

Searching

-

Extension

flag

-

Zip, address 1, address 2

Enter the zip and address of the correspondent.

-

TEL 1/TEL 2, FAX

Enter the telephone No. and FAX No. of the

correspondent.

-

E-mail 1/E-mail 2, URL

Enter the E-mail address and URL of the

correspondent.

-

Segment code

Enter a code for the business segment to which the

correspondent belongs, which is used in [Consolidation control module]

of [Disclosure subsystem]. Up to

20 alphanumeric characters can be entered.

The set segment code can be specified as the summary unit of consolidated data.

-

Consolidated correspondent code

Enter the correspondent code to use in the consolidated accounting

package. Up to 20 half-sized

alphanumeric characters can be entered.

-

TAX ID 1/TAX ID 2

This is an item for compliance with the tax system

of Singapore (GST No.), etc. Use

as required. Up to 20 English one

byte characters including half-sized hyphens can be entered.

-

Region

Enter the region to which the correspondent

belongs. Select from the regions

registered in [Register region]. When a region with the

"Export

restriction" check box ON in [Register region] is selected, "STC setup" on the [Sales/Purchase 1] tab is required.

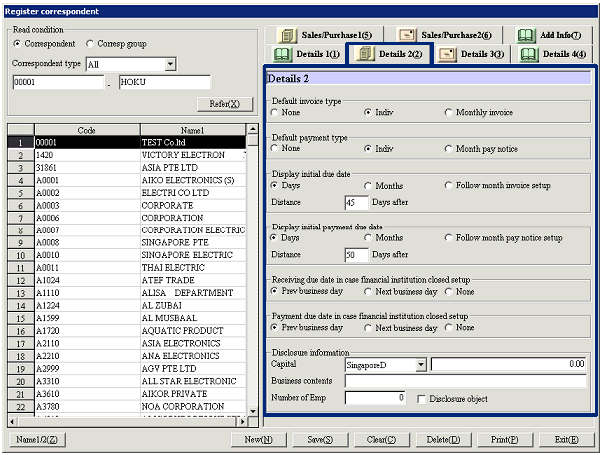

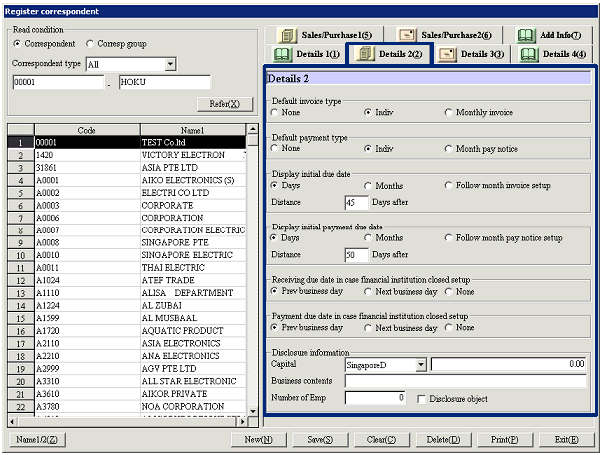

Item Setup - [Details 2] tab

Item Setup - [Details 2] tab

- Enter details (1)

-

Invoice type (default), payment

type (default)

Select default types of invoice for sales control

and claims and of payment for purchase control and debts. Options include:

"None," "Indiv" and "Monthly

invoice/Monthly payment notice."

-

Display initial due date, payment

due date

Specify conditions for automatic calculation of defaults of "Scheduled

receipt date" of sales control and claims and of "Payment due date" of purchase

control and debts.

|

Specification

|

Comment

|

|

Days

|

Specify the number of days after the

entry date. Enter the number of

days in "Distance-Days after."

|

|

Months

|

Specify the number of months after the

entry date. Enter the number of

months in "Distance-Months after."

|

|

Follow monthly invoice setup/

Follow monthly payment notice setup

|

Set "Closing date," "Monthly margin," "Issue

date" and "Collection date/Payment date" in "Monthly invoice setup" and "Monthly

payment notice setup" of the [Details 4] tab.

|

-

Receiving due date in case

financial institution closed setup

Select a receiving due date to substitute for the

original due date when it falls on a holiday of financial institutions. Options are:

"Previous business day," "Next

business day" and "None." The

default is "Previous business day."

When the calculated receiving due date coincides with a holiday set in [Register calendar] of [Common master module],

the date is replaced by "Previous business day" (the day before the holiday) or "Next business day" (the day after the holiday) or not changed ("None")

according to the setting.

Substitution may apply to: "Receiving due date" in sales Control, "Receiving

due date" in claims and "Due date" in notes receivable.

-

Payment due date in case financial

institution closed setup

Select a payment due date to substitute for the

original due date when it falls on a holiday of banks. Options are: "Previous business day,"

"Next

business day" and "None." The default

is "Previous business day."

When the calculated payment due date coincides with a holiday set in [Register

calendar] of [Common master module], the date is replaced by "Previous business

day" (the day before the holiday) or "Next business day" (the day after the

holiday) or not changed ("None") according to the setting. Substitution may apply to:

"Payment due

date" in sales Control, "Payment due date" in claims and "Due date" in notes

receivable.

-

Disclosure information

Enter information on "Capital" (currency, amount), "Business

contents" and "Number of Emp."

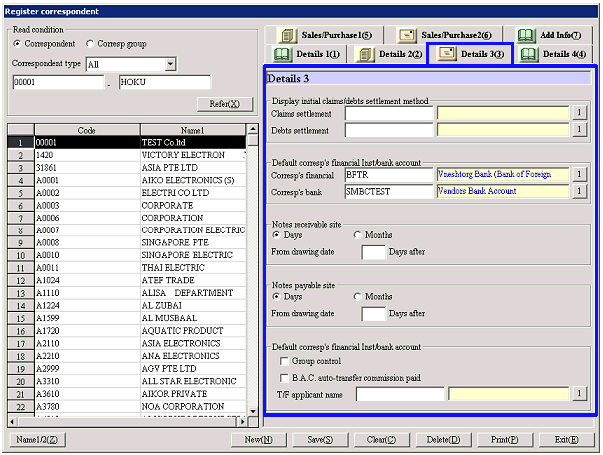

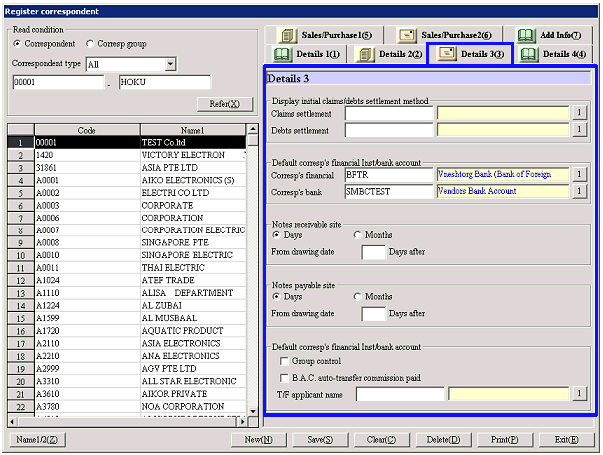

Item Setup - [Details 3] tab

Item Setup - [Details 3] tab

- Enter details (3)

-

Display initial claims/debts

settlement method

Set the "Claims settlement method" and "Debts

settlement method" to be displayed by default when entering transactions with

this correspondent. This setting

is optional. The options of

methods are claims settlement methods registered in [Register

claims settlement method] of [Claims control module] and debts settlement

methods registered in [Register

debts settlement method] of [Debts control module].

When "Claims/Debts-B.A.C. interlocking" is set to "Interlock" in [Parameter setup]

of [System custodian module], entry of "Claims settlement method code" is required

for correspondents that receive by auto-transfer.

When "Claims/Debts-B.A.C. interlocking" is set to "Interlock" in [Parameter setup]

of [System custodian module], entry of "Debts settlement method code" is

required for correspondents that pay by auto-transfer.

-

Other setup

Set the "Corresp's financial Inst" and "Corresp's bank account" to be

displayed by default when entering transactions with this correspondent. This setting is optional. The options are financial institutions

registered in [Register financial

institution] of [Common master module] and bank accounts registered in [Register bank account] of [Common master module].

"Corresp's financial Inst" is displayed by default in "Finncl Institutn" of

entries of purchase control, "Corresp's financial Inst" of debts and "T/F

source finncl Institutn" of debts.

"Corresp's bank account" is displayed by default in "T/F Dest" of entries of purchase

control, "Corresp's financial Inst" of debts and "T/F source account" of debts.

When "Claims/Debts-B.A.C. interlocking" is set to "Interlock" in [Parameter setup]

of [System custodian module], entry of "Corresp's bank account" is required for

correspondents that pay by auto-transfer.

- Notes receivable site, notes

payable site

Set the "Notes site" to be displayed by default in [Notes

receivable entry] of [Notes receivable module] and [Notes payable

entry] of [Notes payable module].

|

Specification

|

Comment

|

|

Days

|

Specify the number of days after the

drawing date. Enter the number

of days in "From drawing date-Days after."

|

|

Months

|

Specify the number of months after the

drawing date. Enter the number

of months in "From drawing date-Months after."

|

-

Group control

To issue notes by individual correspondent group in [Bulk

notes payable entry] of [Notes payable module], the correspondent with this

box checked is displayed by default as the correspondent in status after notes

divide. Group control is available

for only one correspondent in a correspondent group. The correspondent set for group control is marked with a red

icon for identification on the [Register structure] tab of [Register correspondent group].

|

Correspondent

|

Amt

|

→ when divided by two →

|

Correspondent

|

Amt

|

|

Company A

|

10,000

|

Company A

|

40,000

|

|

Company A

|

20,000

|

|

Company B

|

30,000

|

|

Company C

|

10,000

|

Company A

|

40,000

|

|

Company D

|

10,000

|

|

Total

|

80,000

|

-

B.A.C. AUTO-TRANSFER COMMISSION

PAID

If the correspondent pays transfer commissions in [Bank account control module],

check this check box. Uncheck the

box if your company pays transfer commissions.

When "Claims/Debts-B.A.C. interlocking" is set to "Interlock" in [Parameter setup]

of [System custodian module], the entry is required.

-

T/F applicant name

Set the T/F applicant name to be displayed by

default when entering this correspondent as the T/F destination in [Debts

entry] of [Unpaid control module], [Payment

plan adjustment entry] of [Debts control module] and [Purchase entry] of

[Purchase control module]. Options

are transfer applicant registered in [Register

transfer applicant] of [Debts control module].

When "Claims/Debts-B.A.C. interlocking" is set to "Interlock" in [Parameter setup]

of [System custodian module], the entry is required.

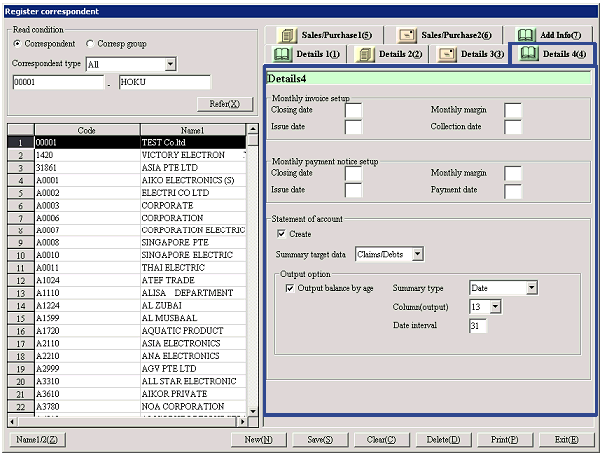

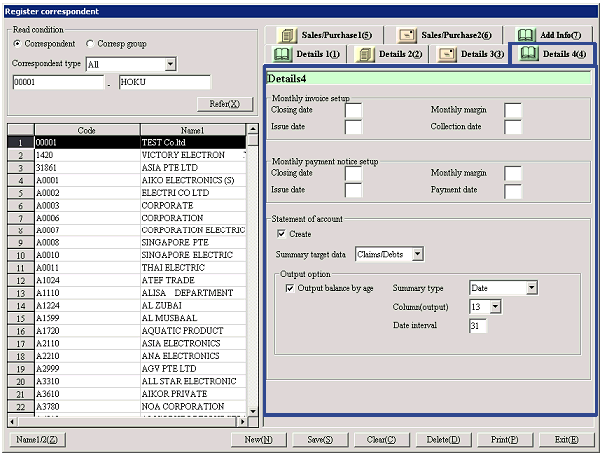

Item Setup - [Details 4] tab

Item Setup - [Details 4] tab

- Enter details (4)

-

Monthly invoice setup, monthly

payment notice setup

Set the date to be displayed by default for the closing date to be used in [Issue monthly

invoice] of [Claims control module] and [Issue

monthly payment notice] of [Debts control module].

-

Closing date

Set the closing date between "1" and "31"

inclusive. Enter "31" when the

last day of the month is the closing date.

-

Monthly margin

Set the monthly margin between the closing date and

the collection date/payment date. Enter "0" if the collection date/payment date is in the same month as the closing

date, "1" if it is in the next month and "2" if it is in the month after next.

-

Issue date

Set the bulk invoice/bulk payment voucher issue

date between "1" and "31" inclusive.

Enter "31" when the last day of the month is the issue date. If the date is the same as or after the

closing date, it is regarded as in the same month as the closing date. If it is before the closing date, it is

regarded as a date in the next month.

-

Collection date/Payment date

Set the collection date/payment date between "1"

and "31" inclusive. Enter "31"

when the last day of the month is the date.

-

Statement of account

Check the check box if this is the correspondent for which statement of

accounts is created.

Set the following items if the check box is checked:

-

Data to summarize

Select "Claims data only," "Debts data only" or "Claims/Debts."

Options depend on the "Correspondent type" set on the [Details

1] tab as shown bellow:

For "Vendor": fixed to "Debts data only"

For "Cust": fixed to "Claims data only"

For "Cust & Vendor" or "Related company": any of "Claims data only,"

"Debts data only" and "Claims/Debts" can be selected

-

Create option (displayed only when "Statement

of account setup" is ON)

Set the following items if the "Statement of

account setup" check box is checked:

-

Output aging report

Check the check box to specify as an object of

aging report output.

Set the following items if the check box is checked:

Summary type:

Select "Month" or "Date."

Output number of column:

Select the number between "1" and "13" inclusive.

Date interval:

Enter a number between "1" and "99" inclusive.

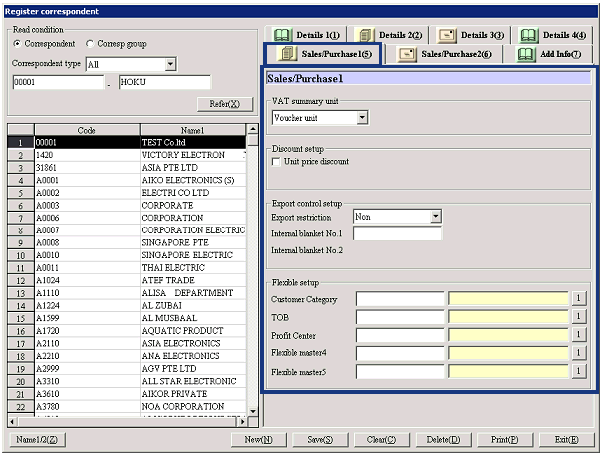

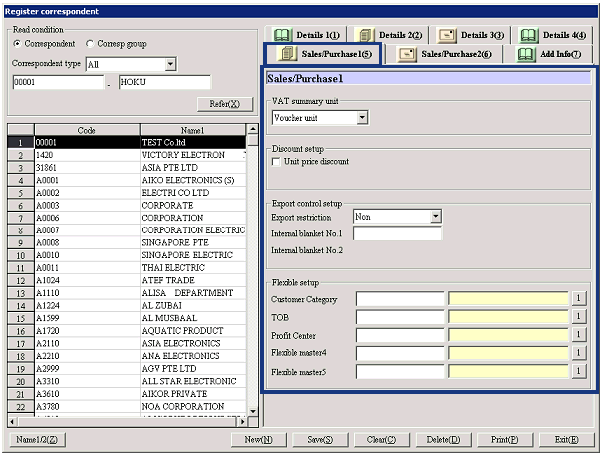

Item Setup - [Sales/Purchase 1] tab

Item Setup - [Sales/Purchase 1] tab

- Enter sales/purchase information (1)

- VAT summary unit

Register the "VAT summary unit" for this correspondent. VAT is calculated based on the summary

unit set here.

|

Summary unit

|

Details

|

|

None

|

Select this when no VAT is entered. When "None" is selected, taxable

types cannot be set for individual entries.

When not using [Sales control subsystem], or "Purchase control subsystem,"

select "None" for all correspondents.

|

|

Detail row unit

|

Select this when VAT is entered for

individual detail row. When "Detail

row unit" is selected, VAT (taxable type) can be set for goods/charges.

|

|

Voucher unit

|

Select this when VAT is entered for

individual voucher. When "Voucher

unit" is selected, taxable types cannot be set for individual goods. VAT is summarized in charges with the

charges type specified as "VAT." "Taxable type" specifying the taxable type to be displayed by default

on the voucher entry screen is displayed only when "Voucher unit" is

selected.

|

-

Taxable type (sales), taxable type (purchase)

Set the taxable type to be displayed as default on the entry screen.

This is displayed only when "VAT summary unit" is "Voucher unit." Options depend on the

"Correspondent

type" set on the [Details 1] tab as shown bellow:

-

For "Vendor": Only "Taxable type (purchase)"

will be displayed

-

For "Cust": Only "Taxable type (sales)"

will be displayed

-

For "Cust & Vendor" or "Related

company": both "Taxable type (sales)" and "Taxable type (purchase)" will be

displayed.

-

Discount setup

This is an item for future enhancement and currently

unused.

-

STC setup

Make the following settings for correspondents to

which export control restriction applies:

-

Export restriction

Specify whether the correspondent is to be the

object of export control restriction by selecting "Applied," "Not applied" or "(blank)."

To specify the correspondent as the object of export control restriction,

select "Applied." When a region

with the "Export restriction" box checked in [Register region], "Applied" must

be selected.

When " (blank)" is selected, the

correspondent is regarded as unregistered. Specifying this correspondent in

"Accountee," "Consignee" or "End user" on the [Sales

order entry 1] screen generates an STC error "INI" on the [Sales order gate] screen.

-

Internal blanket No. 1, 2

Up to 15 English one byte characters including

half-sized hyphens can be entered.

When a number is entered, enter the corresponding term of validity. Terms of validity for internal blanket

No. 1 and No. 2 cannot overlap.

If an item with "#(STC object)" or "%(inspecting goods)" set in "STC type" in [Register goods] of

[Logistics master] is ordered, specifying a correspondent without "Internal

blanket No." in the term of validity in "Accountee," "Consignee" or "End user"

on the [Sales order

entry] screen generates an STC error "E4" on the [Sales order gate] screen.

-

Flexible setup 1-5

Select from flexible masters registered in [Register

flexible master (register correspondent)] of [Flexible master management]. Names displayed such as

"Flexible

master 1" can be changed in [Additional

information name setup (master/common)] of [System custodian module].

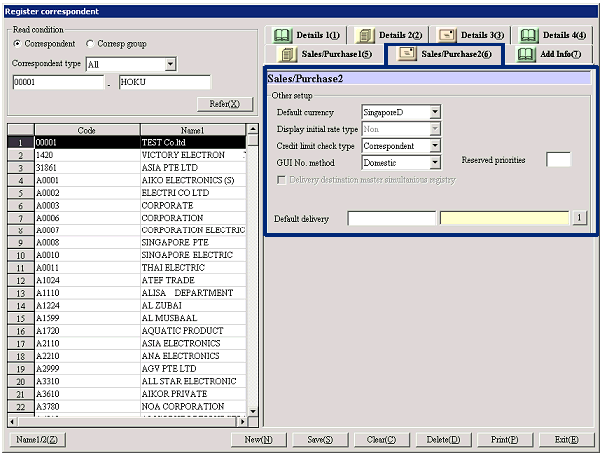

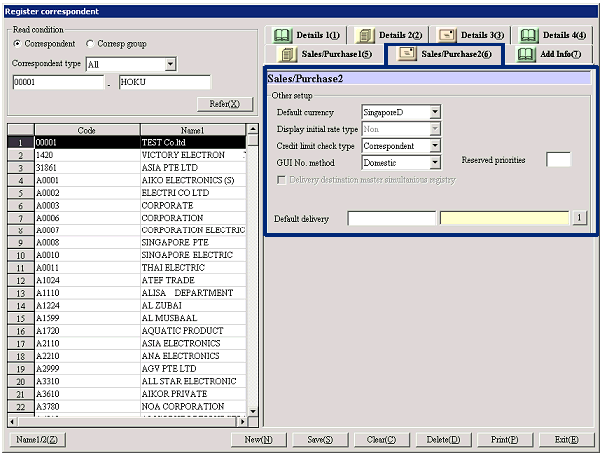

Item Setup - [Sales/Purchase 2] tab

Item Setup - [Sales/Purchase 2] tab

- Enter sales/purchase information (2)

-

Default currency

Select the currency to be displayed as default from

currencies registered in [Register currency]. The Std currency is displayed by

default.

-

Display initial rate type

When a foreign currency is selected in "Default

currency," select the rate type to be displayed by default for the

corresponding currency from the following options: "None," "TTB," "TTS," "TTM," "Internal rate,"

"Cach-S," "Acceptance-S," "AS-B," "Usance-B," "AS (NoneL/C)," "Cach-B." For Std currency, this

is always "None" and cannot be change.

-

Credit limit check type

Select the unit of credit control in [Register credit limit]. Select "No,"

"Correspondent" or "Correspondent

group."

Correspondents with different check types cannot be registered in the same

correspondent group in [Register

correspondent group]. If check

types are once used in [Register credit limit] or [Register correspondent

group] for registration, the types cannot be changed unless the registration is

deleted.

-

GUI No. numbering type

This is an item for compliance with the tax system

of Taiwan. Enter "Domestic" or "Foreign"

as required.

-

Reserved priorities

Up to three half-sized numbers can be entered for

priorities for bulk reservation of inventory.

The priorities entered here are referred to when "Accountee" is specified as

the priority key for bulk reservation of goods for more than one sales order

data in [Sales reserve]

of [Sales order module]. If the

numbers are the same, the correspondent codes are further referred to.

-

Delivery destination master

simultaneous registry

The box can be checked only at new registration. The status cannot be changed after

saving. Be sure to check the box

for correspondents to register as delivery destinations. Only the correspondents with the box

checked are copied to [Register

delivery to] of [Logistics master module] and can be registered as delivery

to.

Checking this check box automatically copies the correspondent to "Default

delivery destination" at saving and registers as delivery to at the same

time. "Outgoing warehouse" is

displayed for entry of default outgoing warehouse as a delivery destination.

Notes: If a correspondent simultaneously registered in the delivery destination

master is deleted in [Register correspondent], the data of the correspondent as

a delivery destination remains in the system. To delete the information as a delivery destination,

individually delete in [Register delivery to] of [Logistics master module].

-

Outgoing warehouse (displayed only

when Delivery destination master simultaneous registry box is checked at new

registration)

Enter the default outgoing warehouse to delivery

destination. The outgoing

warehouse registered here is displayed in [Register delivery to] of

[Logistics master module] by default, which allows use as a delivery

destination only by registering structure with [Register delivery to].

-

Default delivery destination

Enter the correspondent to be displayed by default as a delivery destination or

vendor when a correspondent concerned is displayed at sales or purchase data

entry. Only correspondents

registered in [Register delivery to] can be entered here.

If a new correspondent is registered and saved with the "Delivery destination

master simultaneous registry" check box checked, the correspondent concerned is

automatically set as the default delivery destination and registered as a

delivery to at the same time.

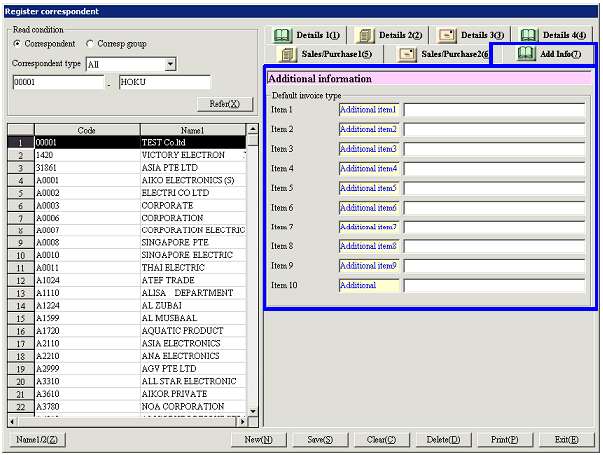

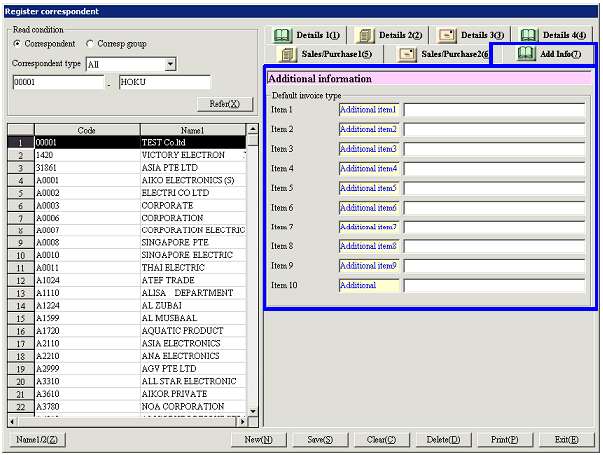

Item Setup - [Additional information] tab

Item Setup - [Additional information] tab

- Enter additional information

Buttons

Buttons

-

Name1/2

-

New

-

Save

-

Clear

-

Delete

-

Print

Correspondents to be output can be specified by "Correspondent type" ("All,"

"Vendor," "Cust," "Cust & Vendor" or "Related company").

-

Exit

![]() Register correspondent

Register correspondent![]() Screen Transition

Screen Transition

![]() Item Setup - [Sales/Purchase 1] tab

Item Setup - [Sales/Purchase 1] tab

![]() Item Setup - [Sales/Purchase 2] tab

Item Setup - [Sales/Purchase 2] tab

![]() Item Setup - [Additional information] tab

Item Setup - [Additional information] tab

![]() Buttons

Buttons